Staff Reporter

Financial leaders reject ‘Global South’ label over tech boom reality

Financial leaders reject ‘Global South’ label over tech boom reality

Financial distress is not an emerging market-only problem.

Mastercard, Thunes expand stablecoin wallet payouts worldwide

Mastercard Move currently supports over 200 markets and 150 currencies.

DBS, Ant International deepen ties to enhance cross-border payments

DBS PayLah! users will soon be able to make payments at Alipay+ merchants.

Ant International's Antom unveils app to link POS, banking and lending for MSMEs

The app will first launch in Singapore.

Visa Inc. launches pilot to send payouts to stablecoin wallets

The system aims to speed up global payments and provide quicker access to funds.

Five takeaways from day 1 of the Singapore Fintech Festival

Tokenisation emerges as a key driver of future digital money systems.

From apps to ambient: banks urged to embrace 'invisible finance'

Industry players are integrating services into everyday devices and platforms.

DBS chief calls for human-centric approach to AI

It integrates AI across its operations whilst keeping the bank human-centric and trusted.

SMBC rolls out AI tools to assist CFOs, expand financial inclusion

It also plans to create frameworks to ensure AI reliability and transparency.

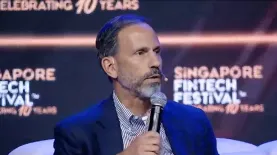

AI holds ‘tremendous potential’ for fraud detection, says Swift CEO

Artificial intelligence (AI) is set to reshape fraud detection and financial crime prevention across the global financial system, according to Swift Chief Executive Officer Javier Pérez-Tasso.

Why finance leaders push tokenisation as next phase of digital money

Tokenised deposits invert the model, allowing banks to deliver liquidity directly where required.

Ant International uses AI to predict liquidity, FX needs

Falcon TST now handles about 60% of the company’s global transactions.

Mastercard bets on ‘agentic commerce’ to transform payments

Central to this effort is Mastercard’s Agent Pay framework.

Finance chiefs cite deepfakes, synthetic identity attacks as top AI concerns

Human oversight remains crucial to manage AI safely.

SG, UK launch first-ever AI in finance collaboration

It aims to enhance cross-border opportunities for financial institutions and AI firms.

Singapore builds a three-tier strategy to future-proof its workforce

The plan spans basic AI literacy to advanced development as technology reshapes jobs.

Singapore pursues digital economy ties with ASEAN and global blocs: DPM

DPM Gan also said Singapore is focusing especially on financial services to stay globally relevant.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership