Frances Gagua

Siam Commercial Bank buys Home Credit Vietnam Finance for $849m.

Siam Commercial Bank buys Home Credit Vietnam Finance for $849m.

The transaction is expected to be completed in the first half of 2025.

UOB’s Christine Ip reflects on 3-decade banking career and circling back to the arts

Ip believes that finance and creativity go hand-in-hand in building a holistic pool of talents in UOB.

Citi’s Shally Koh on how to foster a more diverse banking organisation

The bank is touting its male allyship and mother support programs as part of its bid for gender equality.

StanChart's Maisie Chong on never saying no to seizing opportunities, paying it forward

Chong shares the joy of finding greater satisfaction and fulfilment through the course of work.

Hong Kong’s Mox Bank offers digital money transfer services in 10 currencies

Exchange fee is as low as 0.35%.

Ex-CEO, directors of Envision Wealth Management charged by MAS

They allegedly committed offences against the Securities and Futures Act, amongst others.

India’s HDFC Bank penalised by state tax officer of Gujarat

This is due to “disallowance of input tax credit” under section 73 of the CGST Act.

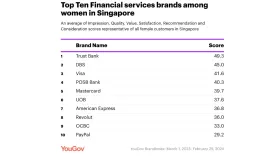

Trust Bank is most positively viewed financial brand by Singaporean women

It beat out other banking heavyweights and card network giants to emerge on top.

Mox Bank, CMB Wing Lung Bank warns of fake websites

Both banks have reported the incidences to the Hong Kong Monetary Authority.

BOCHK warns against fraudulent website

The bank denied any connection to the site and has reported it to authorities.

OCBC’s Mayda Lim in building the next pipeline of tech, banking talent

Lim weaves the need to support women bankers with the wider talent shortage in the industry.

CIMB Islamic, PETRONAS inks deal for Islamic commodity derivatives

This is PETRONAS’ first venture towards Shariah-compliant derivatives.

No record-high earnings for Singapore banks in 2024, but loans to recover

The US Federal Reserve is expected to start cutting rates in mid-2024.

Mox Bank launches 24/7 equities and fund trading services

Customers can invest as little as HK$1.

Currencycloud obtains In-Principle Approval for MPI licence in Singapore

It offers to ability to collect, convert, and spend multiple currencies across 180 markets.

Thailand publishes rules for virtual bank license applications

Applications begin on 20 March until 19 September 2024.

CIMB Personal Loan offers 2.8% interest rate per annum

Loans of over S$30,000, with a tenure of at least 3 years, can qualify for this.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership