Frances Gagua

Malaysia’s GX Bank outlines brand purpose of financial inclusion and literacy

Malaysia’s GX Bank outlines brand purpose of financial inclusion and literacy

It focuses on individuals with a median household income of RM3,000 and gig workers.

Japan banks clinch $1.98b boost in interest income after policy shift

But a rise in deposit rates presents risks, analysts warned.

BSP says ‘Currency Computing Mining Machines’ not under its purview

The Philippine central bank also warned against SKPOOLS MINING CORPORATION.

The Philippine central bank has warned the public against “Currency Computing Mining Machines”, saying that these are not within its purview.

Foreign banks’ Korean earnings up 6% on higher securities income

The net interest margin declined from 0.75% to 0.63%, according to official data.

DBS and JPMAM unveils investment portfolio for retirement needs

The portfolio calibrates asset allocation depending on investors’ life stages.

BOCHK warns against 4 fake websites

The sites purport to be from a logistics service provider and online trading platform.

Asia's Voluntary Carbon Markets Beyond the Storm: New Opportunities for Financial Services?

There is considerable potential that voluntary carbon credits can become an asset class in its own right.

Banks fine but SMEs at risk by Japan's 'historic' policy shift

SMEs may see more challenges from the higher interest rates and higher wages.

Japan exits negative interest rate policy on record wage hikes

With salaries rising by 5.28% on average, the BOJ sees cycle of wages and prices more “solid”.

Ping An Bank with enough capital for proposed higher dividends: analyst

The China-based bank has proposed to pay a 30% dividend in 2023.

BOCHK warns of fake websites

The websites reportedly intend to steal customers’ data.

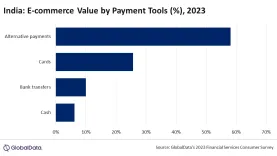

1 in 4 e-commerce transactions in India use alternative payments

Cash makes up barely 1 in 10 of transactions, according to GlobalData.

Mastercard and Alipay enable real-time remittance in over 180 markets

Alipay’s 1 billion users in China can now transfer and pay with over 150 currencies.

Hong Kong reports 8,600 average withdrawals per ATM in a month: study

Average usage levels per ATM is expected to rise as the number of ATMs decreases.

Are ATM cash withdrawals making a comeback?

About 2 in 3 markets studied saw ATM withdrawals rise as inflation squeezes on income.

How have banks’ wealth management pivots played out?

There’s up to $25b in fees to be made in Asia, but it’s a tough market, an analyst said.

Philippine neobank Zed offers credit card with no interest and no annual fees

It has reportedly received 25,000 sign-ups within three weeks.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership