mobile wallets

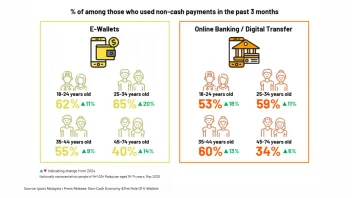

E-wallet use jumps to 65% amongst Malaysia’s 25- to 34-year-olds

E-wallet use jumps to 65% amongst Malaysia’s 25- to 34-year-olds

Older users logged a 14% rise year on year but still trail younger groups on this method.

Banks may be ill-equipped for demands of real-time payments

Stronger fraud prevention and anti-money laundering measures are needed.

APAC mobile wallet adoption driven by e-commerce growth

Immediate payment systems fuel continued expansion of mobile wallet usage.

India crackdown on non-bank lending to hit fintech investments

Deal activity in Q2 was 25% lower than the previous quarter.

E-payments poised to replace credit cards in China, Indonesia: Experian

Buy now, pay later has been eagerly embraced by Indonesians.

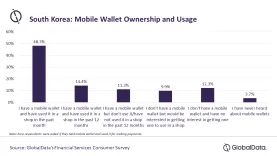

Chart of the Week: Mobile wallet payments pick up pace in South Korea

High smartphone and internet use drive its use.

The Next Pedestal of the Payments War for Banks and FIs: Buy Now Pay Later

Buy Now Pay Later (BNPL) has seen remarkable growth in recent years and is on track to achieve a global market value of US$700b by 2023. This 90% compound annual growth rate (CAGR) reflects the growing penetration of this simple transactional instrument—consumers purchasing a product now with the agreement to pay for it later.

APAC’s mobile wallet adoption chips away at traditional payments’ dominance

Mobile wallet adoption in Thailand, Vietnam far exceed those in the US, the UK.

SEA named world’s fastest-growing mobile wallet region

The number of active mobile wallets is expected to reach 439.7 million by 2025.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision