Asia's wealth managers faced with potential $25m revenue boost

Rising income will push the affluent and mass affluent segments’ wealth pool to $4.7t.

Banks and wealth managers in Asia have the potential to increase their revenues by up to $25b over the next four years as the region’s affluent and mass affluent segment’s incomes rise, according to a report by McKinsey & Co.

The wealth pool from these segments—which McKinsey defines as households with investable assets of $100,000 to $1m–is projected to hit $4.7t by 2026, growing $2b from the $2.7 in 2021.

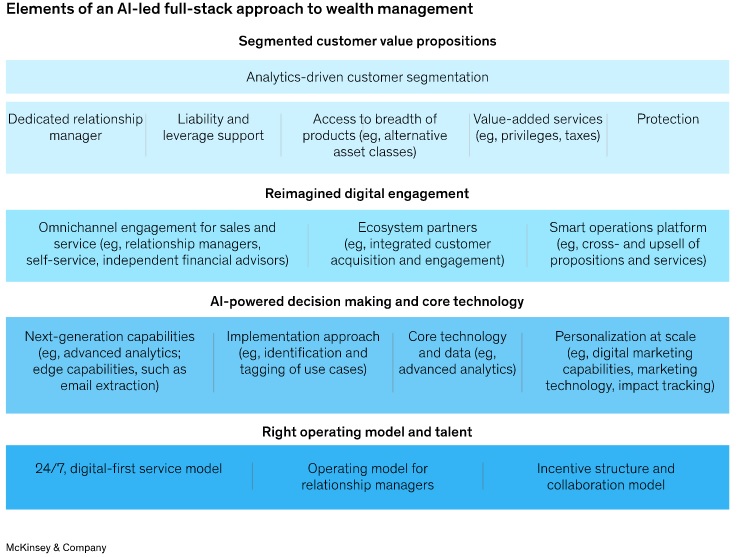

Banks and wealth managers now face the challenge on how to tailor their approach across four dimensions: segmented customer value propositions, reimagined digital engagement, AI-powered decision making and core technology, and the right operating model and talent, according to McKinsey.

“This is a rare opportunity in financial services—a fast-growing segment that is currently underserved and, according to our recent research, increasingly open to paying for wealth management services,” McKinsey’s Asia wealth service line analysts said in the report, “Digital and AI-enabled wealth management: The big potential in Asia.”

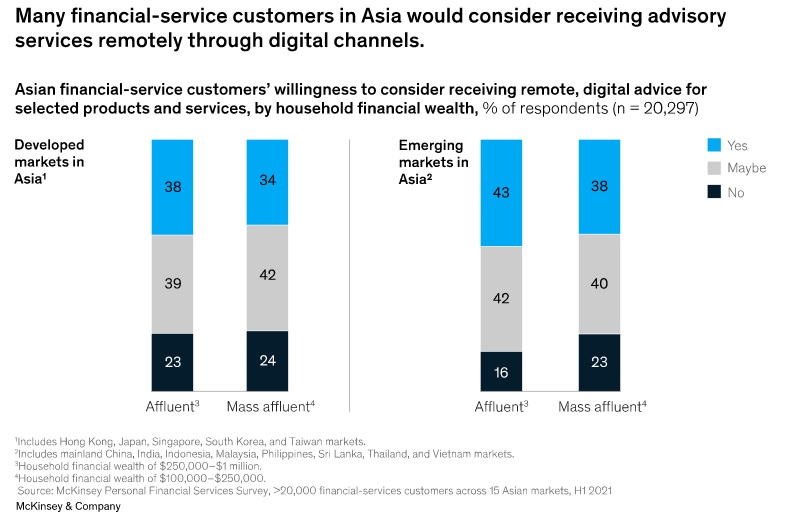

Good news for wealth managers: these segments are more open to receiving advisory services remotely through digital channels. In a separate survey, McKinsey found that approximately 4 in 5 or 80% of the affluent and mass affluent respondents in Asia would consider this.

Almost 9 in 10 or 87% of investors in developed markets within Asia, and 64% in developing markets say they are willing or may be willing to pay advisory fees, the study also found.

McKinsey suggested offering personalized recommendations based on the needs of specific segments.

“Even within a seemingly homogeneous group–such as affluent and mass-affluent investors–a great deal of variation exists in investing experience, willingness to make one’s own investment decisions, desire for advice or planning services, attitude toward risk, preference for digital versus face-to-face engagement, and many other variables,” the report noted.

With customers expressing willingness to consider digital wealth advisory, banks and wealth managers should also strike a balance between personal interactions and digital interactions, the management consultancy firm added, rather than just in-person, on-site meetings.

Advertise

Advertise