Lending & Credit

Some Indian banks misguiding investors on bad loans: Deputy Governor

Some Indian banks misguiding investors on bad loans: Deputy Governor

Reserve Bank deputy governor K C Chakrabarty criticized banks for misguiding investors for the past five years by not giving your proper figures on...

Pos Malaysia to provide micro credit to SMEs

Pos Malaysia has acquired the entire stake in Pos Ar-Rahnu Sdn Bhd to be used as the joint venture company.

Exploring hedge funds around the world

Hedge funds and their managers have in recent times vilified for their high-risk activities and relative lack of regulatory oversight. Recall that...

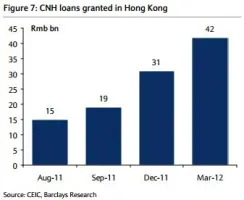

CNH loans granted in Hong Kong reaches RMB 42b

The 3-5% CNH lending rates in Hong Kong still prove to be more attractive than CNY lending rates in China.

Bangladeshis deprived of bank loans due to govt borrowing: politician

Bangladeshi banks could no longer lend to clients due to excessive borrowings by the government.

ICBC promotes equipment leasing service to SMEs

ICBC branches are aggressively marketing the bank's equipment leasing service to SMEs to address their difficulty in accessing bank loan for...

Australian banks shift more fees to small businesses

A Reserve of Australia report showed that households paid 7 percent less bankfees, but businesses paid 5.5 percent more.

Malaysia's EXIM Bank inks reinsurance MoU with UK's ECGD

Malaysia's EXIM Bank aims to establish a basis for the exchange of information, coinsurance, reinsurance and training with ECGD of United Kingdom via...

Syndicate Bank to focus more on retail banking, SME loans

Syndicate Bank is looking to intensify its fee income, retail and SME loans to boost its balance sheet.

Korea's foreign banks see increased overseas borrowing

Foreign bank branches in South Korea have increased their overseas borrowing so far this year.

SME Bank taps BSN branches for collection

With better a collection system, SME Bank expects its NPLs to decrease to 15% by year-end, from 17% last year.

NIDC Bank asked to raise capital

NIDC has been asked by Nepal's central bank to increase its capital so that it could invest more and facilitate growth of productive industries.

Dena Bank to fund agri warehouses

Dena Bank will fund the creation of warehousing infrastructure by Star Agri in Tier 2 and 3 cities.

China's banking authorities deny 30% home lending discounts

The PBOC said reports that it allowed 30 percent lending discounts to first-time home buyers contain deliberate misinterpretations.

TienPhongBank to lend $144M in low interests

TienPhongBank has allocated US$144 million to provide low-interest loans for enterprises.

S. Korean banks warned against loan defaults

Loan delinquency rates have accelerated in Korea, making it imperative for lenders to better manage their loans.

Asia-Pacific tops in mobile banking

The Asia-Pacific will continue to have the most number of mobile banking users in the world.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership