E-Invoicing in Japan: Innovation Opportunities from a Treasurer’s Perspective

By Eiichiro YanagawaElectronic invoice (e-invoicing) is a system to digitize qualified invoices that are mandatory for the deduction of purchase tax under Japan’s qualified invoice system. This system is intended to provide an appropriate consumption tax credit for purchases in response to the multiple tax rates for a consumption tax in 2019, and is scheduled to be introduced in October 2023.

Corporate-to-bank channel connectivity is a critical enabler for businesses of all sizes as they expand globally and the number of banks and accounts needed to conduct business increases. In addition, corporate channels act as the digital backbone for corporate clients to retrieve transaction information, initiate payments, collect receivables, perform reconciliations, and conduct other financial transactions.

Opportunities for innovation

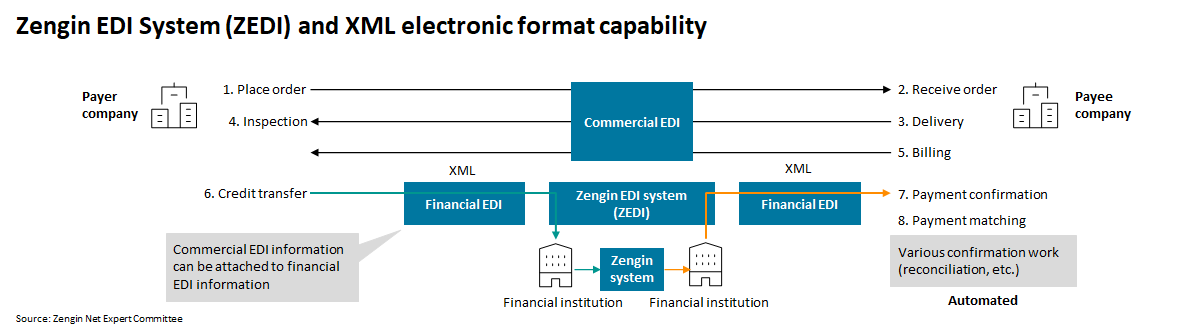

The Zengin electronic data interchange system (ZEDI) is expected to be a good target use case for e-invoicing. On the other hand, the use of ZEDI alone cannot fulfill the preservation requirements of the Act on Special Measures for Preservation of National Tax-Related Books and Documents Prepared Using Computers—“The Act on Electronic Preservation Books/Documents.”

Targets of innovation

Corporate-to-bank channel connectivity is a critical enabler for businesses of all sizes as they expand globally and the number of banks and accounts needed to conduct business increases. Historically, companies used a number of integration methods to exchange financial data, including bank portals, mobile apps, host-to-host files, domestic networks, and the SWIFT network. However, over the past few years, APIs have emerged as a new connectivity channel for bank clients, enabling real time, embedded, and automated data flows between corporates and their banks.

Banks are increasing investments in client connectivity—including open banking APIs—driven by customer demand for real time balance and transaction data and real time payment initiation and reconciliation. Even where a bank already provides APIs, they recognize the need to improve API quality and build out additional APIs to meet customer expectations for usability and functionality.

Adding to the challenge of meeting treasurers’ expectations is that connectivity requirements become more critical and complex as a corporation grows and expands. Large corporations depend on enterprise resource planning (ERP) and treasury management software (TMS) for financial management and payment operations. Small and medium-sized enterprises (SME) embrace a range of accounting software packages and simplified ERP tools. However, no matter the treasury technology tool of choice, regular transaction and payment data feeds are at the core of robust cash flow and working capital management.

Innovation in action

In looking ahead to future corporate-to-bank connectivity, it is clear to both treasurers and corporate bankers that now is the time to develop an API product and channel strategy. The Japanese e-invoicing reform is an opportunity for innovation in corporate banking, where the exchange of invoice data is accelerating and the “corporate-to-bank connectivity landscape from the treasurer’s perspective” is the key to innovation.

Competition and co-creation between financial institutions and fintechs—which see the systemic changes surrounding e-invoicing as a new business opportunity—is expected to shift from ‘digitization’ (defensive DX, replacing existing operations from analog to digital) to ‘digitalization’ (offensive DX, using digital technology to change business models and create new value propositions).

Over the next decade, the winners of SME financial services will look different from today’s banks. Rather than the banking products themselves, simpler accounting workflows, smarter financial data analysis, and practical financial and non-financial advice will be required. In other words, a customer-centric approach will be needed to incorporate banking products and services into a broader range of SME services.

Advertise

Advertise