APAC BaaS market to reach $5.3b as embedded finance surges 148%

Regional revenue is set to climb from $4.44b in 2025 to over $12b by 2031.

The Asia-Pacific Banking as a Service (BaaS) market is estimated to reach $5.26b in 2026, up from $4.44b in 2025, and is projected to grow to $12.31b by 2031, according to a Mordor Intelligence report.

This implies a compound annual growth rate of 18.55% over the 2026 to 2031 period.

The growth reflects a shift towards API-based financial infrastructure, with banks offering core services through white-label platforms and fintech firms embedding payments, identity checks and lending into their own applications.

Juniper Research is forecasting revenue from the embedded finance market to reach $228.6b by 2028. The embedded finance market is expected to earn $228.6b in revenue by 2028, according to a report by Juniper Research. This is 148% higher or more than double the $92.2b in global value recorded in the current year.

“This increasing market maturity and consumer confidence, supported by regulatory initiatives and greater acceptance, particularly within B2B use cases,” Juniper said in its latest report “Embedded Finance: 3 Key Trends for 2024."

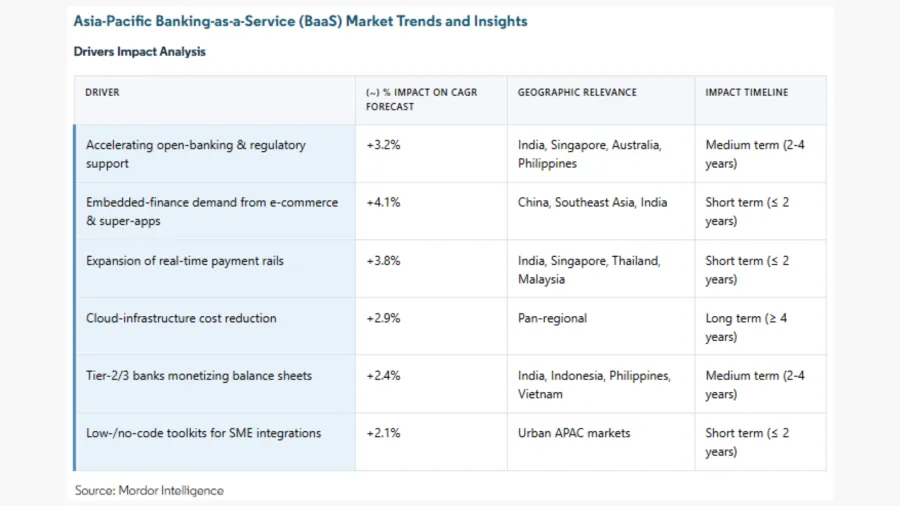

Open-banking rules, the rollout of real-time payment systems and wider use of low-code software tools are accelerating this trend.

Large banks are building API marketplaces, whilst smaller lenders are using their balance sheets and licences to generate fee income by supplying services to fintech partners.

Regulatory changes across the region are also supporting the market. In India, the Account Aggregator framework processed about 1.2 billion data requests in 2024, showing large-scale use of standardised financial data sharing.

Singapore updated its third-party risk guidelines in the same year to set clearer rules for bank–fintech partnerships.

Australia extended its Consumer Data Right beyond banking to cover energy and telecoms, broadening the scope for data-driven financial products.

The Philippines and Malaysia have introduced open-finance roadmaps aimed at improving access to financial services, particularly for unbanked groups.

As legal and technical standards become clearer, banks that have already commercialised their APIs are generating recurring income from BaaS arrangements.

Those that move more slowly risk losing business to digital-first competitors that can offer embedded financial services through partner platforms.

Advertise

Advertise