Banks leverage AI to streamline research and financial analysis

AI is being adopted in use cases outside CRM and as a research assistant.

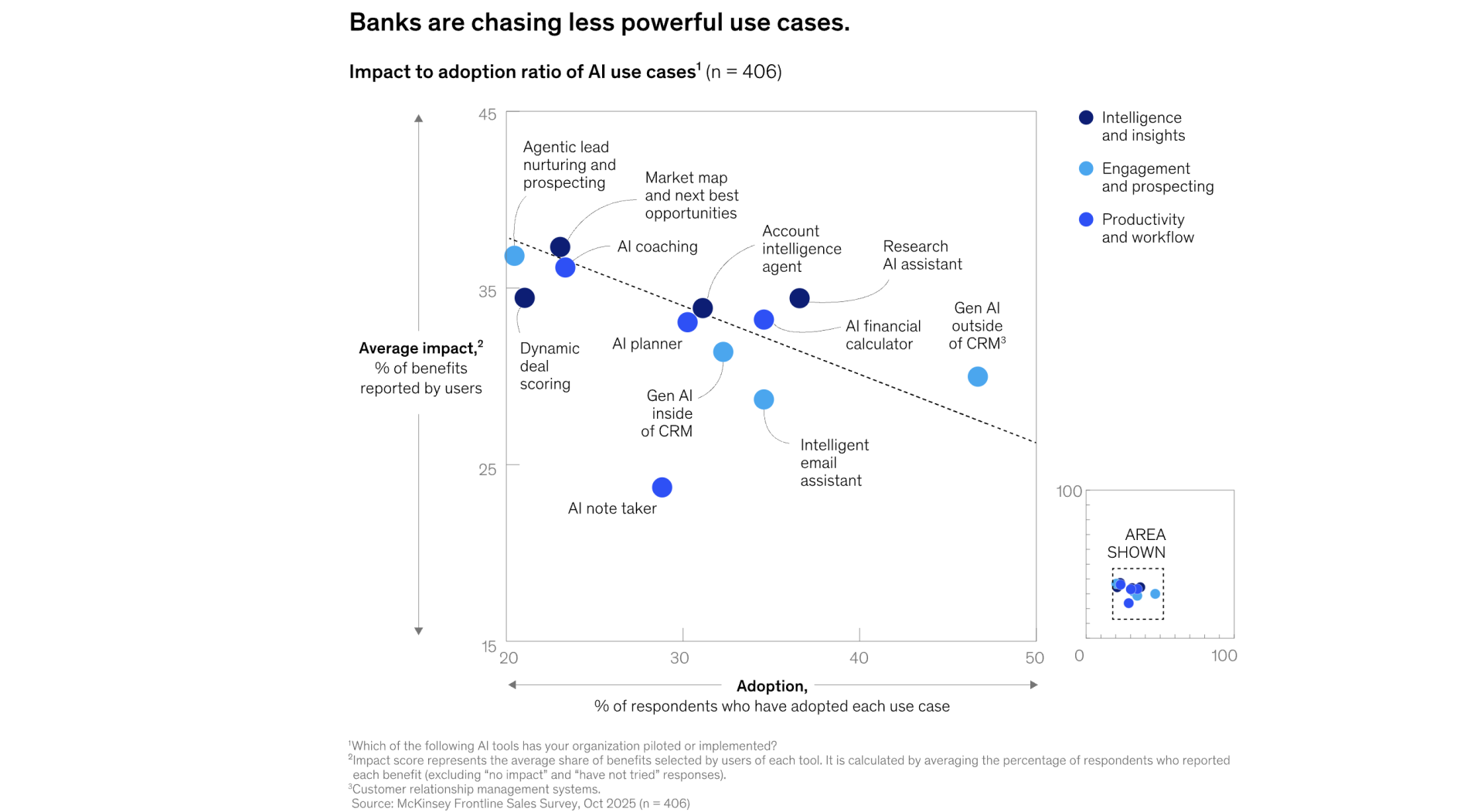

Banks are using and adopting artificial intelligence (AI) fastest in “the least valuable tools,” according to findings by McKinsey & Company.

AI, particularly gen AI and agentic AI, are being adopted most in use cases that are outside of customer relationship management systems (CRM).

Other popular use cases include the research AI assistant, an intelligent AI assistant, and an AI financial calculator.

In contrast, one of the best use cases for agentic AI is in nurturing leads: that is, replying to inquiries, sending personalised content, and scheduling meetings, amongst others.

Too-big-to-fail banks are making use of AI tools to analyse data and offer what they call hyper-personalised services. Citi Wealth has tools such as Advisor Insights, which uses algorithms to suggest engagement opportunities, and AskWealth, which automates research for advisors.

Standard Chartered, meanwhile, has reduced memo underwriting time from days to minutes in its Hong Kong operations.

Advertise

Advertise