Chart of the week: alternative payments used in 1 in 3 online shopping transactions

Singapore’s e-commerce market is forecast to grow by 15% this year.

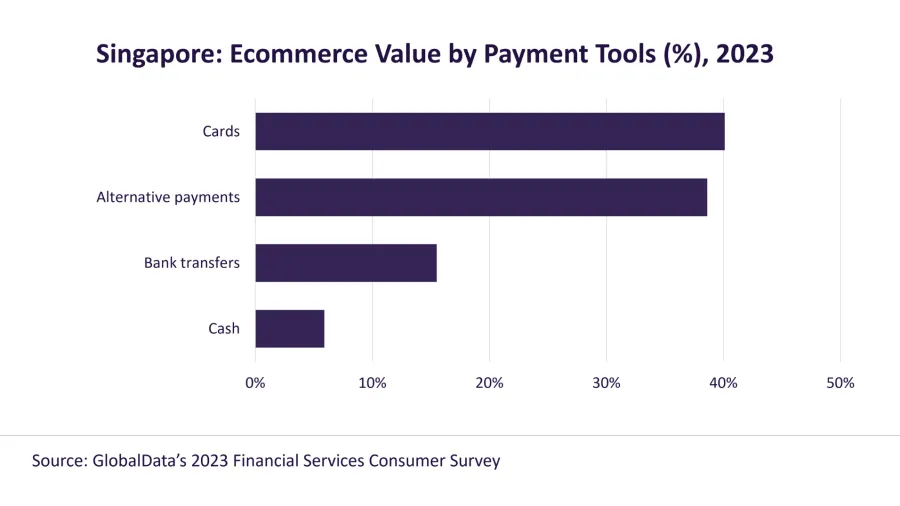

Singapore’s e-commerce market grew 16.9% in 2022, with 38.6% of the payments transactions made using alternative payment methods, according to a report by GlobalData .

Examples of alternative payment methods are mobile and digital wallets.

In terms of value, e-commerce reached S$17.2b in 2022, whilst the market is forecast to expand 15% to S$19.8b in 2023.

“E-commerce sales in Singapore are growing at a robust pace, supported by high internet connectivity and smartphone penetration, and well-developed payment infrastructure. The COVID-19 pandemic has accelerated this shift in consumer preference from brick-and-mortar to online channels,” Kartik Challa, Senior Banking and Payments Analyst at GlobalData said.

In Singapore's e-commerce landscape, payment card usage dominates with a 40.1% share in 2023's total e-commerce transactions. This insight is from GlobalData’s 2023 Financial Services Consumer Survey.

ALSO READ: Alternative payments account for 43.3% of e-commerce purchases in Hong Kong

Additionally, alternative payment providers attract customers by providing cost incentives for frequent use.

GlobalData referenced ShopeePay, for instance, which offers vouchers with up to 80% cashback at partner merchants, along with reward points and free shipping.

The rise of alternative payments is also fueled by the popularity of buy now, pay later (BNPL) solutions.

Notable BNPL brands include Hoolah, Rely, and Atome. Apple also seized this trend by launching Apple Pay Later in June 2023, allowing users to pay for purchases in interest-free instalments, both online and in-store.

“The growing popularity of alternative payment solutions, especially among the millennials, is expected to further accelerate the shift away from payment cards, and these solutions are all set to challenge the dominance of payment cards going forward.” Challa said.

Advertise

Advertise