Chart of the Week: Card payments in China to rebound 21.3% in 2021

Card payments are set to rise as economic activities gathers pace.

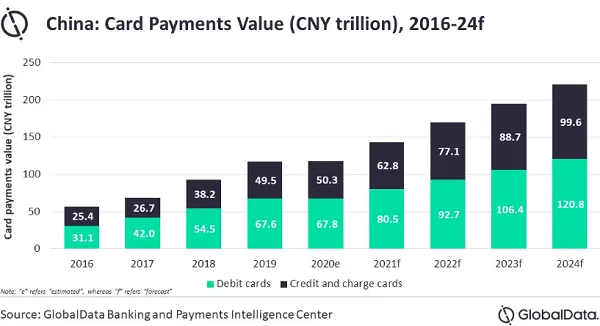

Card payments in China are set to reach $33.8t (CNY220.4t) in value come 2024, with a compound annual growth rate (CAGR) of 16.9% between 2020 and 2024.

The sector is set rebound with a 21.3% growth in 2021 after being hit by the pandemic last year. Such payments have been on a steady growth in the country for the last few years, backed by rising financial inclusion, consumer preference and payment infrastructure, said GlobalData senior analyst Nikhil Reddy.

According to GlobalData’s Payment Cards Analytics, card payments are set to rise as economic activities gather pace and consumer spending improves in the wake of the COVID-19 vaccination program.

The payment card space is dominated by debit cards, accounting for 57.4% of total card payments value in 2020 whilst credit and charge cards comprised the remaining 42.6%.

The value of debit card payments will grow at a CAGR of 14.5% between 2021 and 2024 whilst credit and charge cards will grow at a CAGR of 16.6% during the same period, the report noted.

The government, in collaboration with card issuers and schemes, is also taking various measures to support the card market, including removing the interest rate upper and lower cap from 1 January 2021. This means the interest rate can now be determined by the issuer and card holder through an independent negotiation.

“This initiative will drive competition in credit card space thereby could result in lowering costs for cardholders,” the report added.

Moreover, the entry of international card companies will drive competition in the payment market, which has been predominantly dominated by domestic giant China UnionPay. American Express became the first foreign card company to receive approval to establish a network to clear card payments in China in June 2020.

Advertise

Advertise