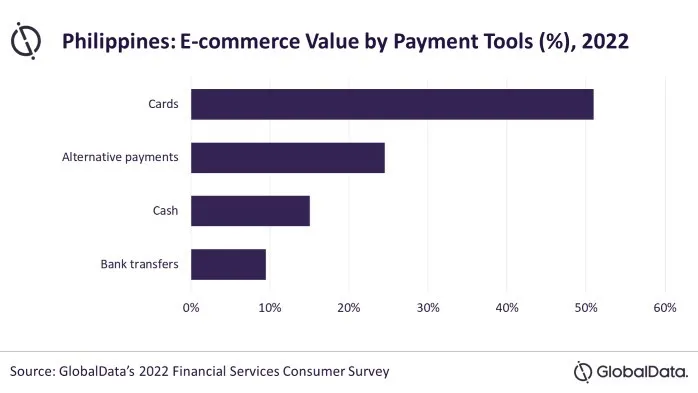

Chart of the Week: Cards account for 51% of e-commerce payments in the Philippines

The Philippines’ e-commerce market grew by 31.3% in 2022

Cards remain the preferred payment tool for e-commerce purchases in the Philippines, according to GlobalData.

Debit, credit, and charge cards collectively accounted for 51% of the payments share in 2022, the data and analytics firm found in a survey. This can be attributed to the value-added benefits offered on payment cards, including interest-free installment payments, reward programs, cashback, and discounts, GlobalData said.

Alternative payment tools such as GCash, PayPal, and PayMaya are the second most preferred payment tools for e-commerce purchases, collectively accounting for a 24.5% share of transaction value during the same year.

“Emergence of new payment models such as buy now pay later, which allows consumers to split total purchase amount into installments are some of the factors supporting alternative payments growth,” said Shivani Gupta, senior banking and payments analyst at GlobalData.

Several players now offer BNPL in the Philippines, notably Atome, BillEase, Akulaku, Cashalo, UnaPay, and TendoPay. E-commerce platform Lazada joined the list with its BNPL service ‘LazPayLater’ launched in November 2022.

The Philippines’ e-commerce market grew by 31.3% in 2022, reaching $9.8b (PHP500.9b), and will reach $12.1b (PHP615.7b) in 2023.

Advertise

Advertise