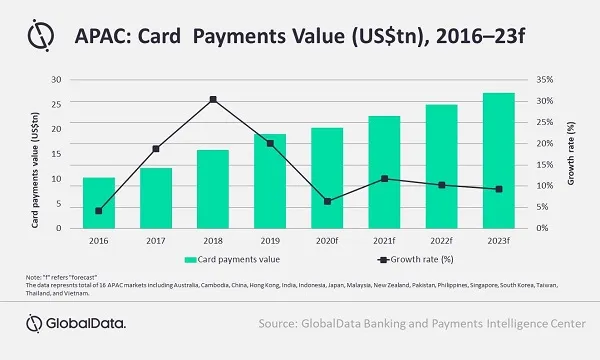

Chart of the Week: COVID-19 hastens digital payments exodus in APAC

Business activities and consumer spending will further fast-track the growth.

This chart by GlobalData shows that the pandemic has expedited the transition to digital payments across the Asia Pacific, with forecasts showing that total card payments will grow 6.5% to $20.3t this year and will likely rise further to $27.4t by 2023.

Even cash-reliant countries like India, Japan, Taiwan, the Philippines, Malaysia, Indonesia, Vietnam, and Cambodia are witnessing a rise in card payments.

With many countries now gradually easing movement restrictions, a growth in business activities and consumer spending is inevitable, which will potenyially have a positive impact on the card payments market, the report said.

Online purchases and increase in preference for contactless payments are aiding the digital disruption, with South Korean online retailers posting 34.3% YoY growth in March on the back of payment cards, according to the country’s Ministry of Trade, Industry and Energy.

Alongside payment cards, mobile payments are expected to become more widespread, with QR-based merchant acceptance solutions like Singapore’s SGQR and Malaysia’s DuitNow QR seeing surge in use, the report concluded.

Advertise

Advertise