Chart of the Week: Debit card fuel growth of Australia’s card payments market

Australians are choosing to spend within their means instead of accruing debt.

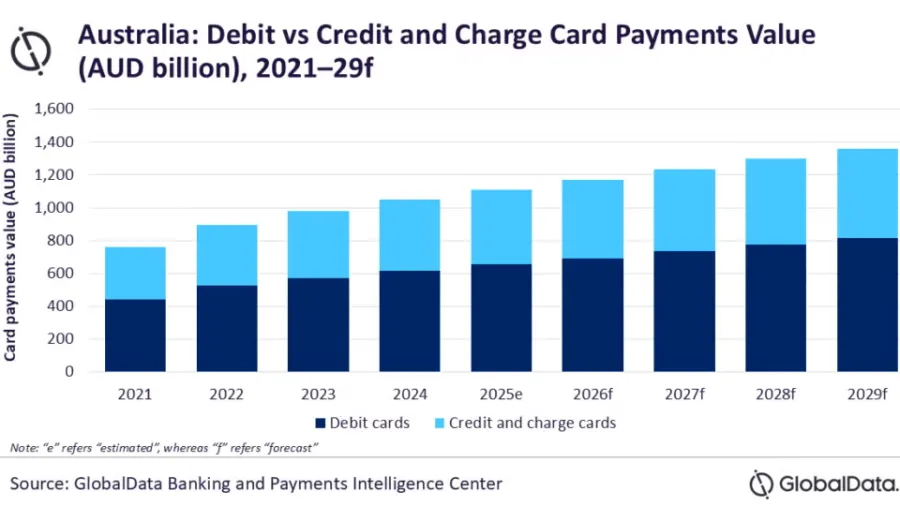

Debit cards are expected to continue driving the growth of Australia’s card payment market through 2029, according to a report by GlobalData.

Australia’s overall card payment market is expected to hit a compound annual growth rate of 5.2% between 2025 and 2029 and be worth $895.9b (A$1.4t) by end-2029.

Debit cards made up 59% of the total card payment transaction value as of 2025, GlobalData said. Annual frequency of debit card payments increased to 245.5 transactions per card in 2025, compared to 213.7 transactions per card in 2021.

“In the face of rising economic uncertainty, Australians are increasingly choosing to spend within their means instead of accruing debt, leading to a higher usage of debit cards,” the report stated.

Low interchange fees and growing preference for contactless payments have further encouraged the use of debit cards, said Kartik Challa, banking and payments senior analyst at GlobalData.

“As the country moves toward a highly digitized society, citizens find it increasingly convenient to access online financial services. In this environment, both fintech companies and digital-only banks have gained a substantial foothold in the debit card market,” Challa said in a press release on 12 September 2025.

The average adoption of debit cards is nearly two cards per individual, GlobalData said.

Meanwhile, the estimated banked adult population in Australia is at 99.6%.

Advertise

Advertise