Chart of the Week: Malaysian card payments to hit $81b by 2023

The interchange fee cap and adoption of new financial tech is helping reduce cash reliance.

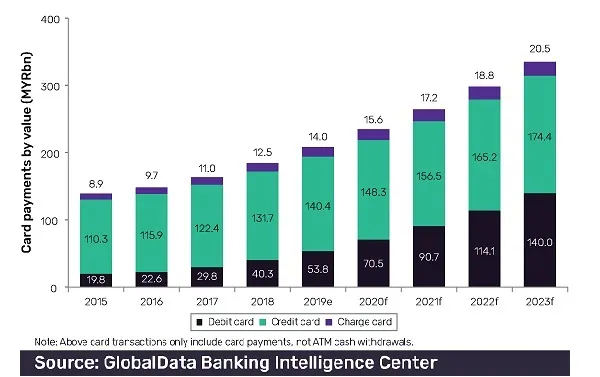

The value of total card payments in Malaysia is set to increase to $81b (MYR334.9b) in 2023, 60.71% higher than the $50.4b (MYR208.2b) recorded in 2019, reports data and analytics company Global Data.

Malaysia remains a cash-dominant economy with 88.1% of payments in 2019 still carried out using cash. The number is set to dip down to 80% in 2023.

The introduction of the interchange fee cap as well as adoption of new financial and cashless technology is helping Malaysia steadily curb its reliance on cash, said Ravi Sharma, senior payments analyst at Global Data.

“Whilst cash continues to dominate overall payments, there has been significant progress in the adoption of card-based payments. The Government initiatives including the introduction of an interchange fee cap, the migration of payment cards to support PIN and contactless payments, and the expansion of point-of-sale (POS) terminals have all contributed to the growth of the payment cards market,” noted Sharma.

Also read: Malaysian e-payment transactions nearly tripled in 2018

Bank Negara Malaysia (BNM), the country’s central bank, has completely waived interchange fees for any payments made via domestic debit cards to the government or its agencies until 31 December 2020.

Scheme providers are also gradually reducing interchange fees. Effective from 1 January 2019, the revised interchange fee of Mastercard and Visa credit cards was set at 0.675%, compared to 1.037% in 2017. In addition, American Express revised its interchange fee on credit cards to 0.575%.

Reduced interchange fees will further boost payment card acceptance among merchants, according to Global Data.

The Government has also set up a Market Development Fund for the development of POS infrastructure with plans to have 800,000 POS terminals in the country by 2020-end.

“Improving payments infrastructure and lower card acceptance cost will further push the use of payment cards in Malaysia over the next five years,” concluded Sharma.

Advertise

Advertise