Chart of the Week: NZ card payments to reach $75.1b by 2028

The market is expected to grow at a compound annual growth rate of 4.1%.

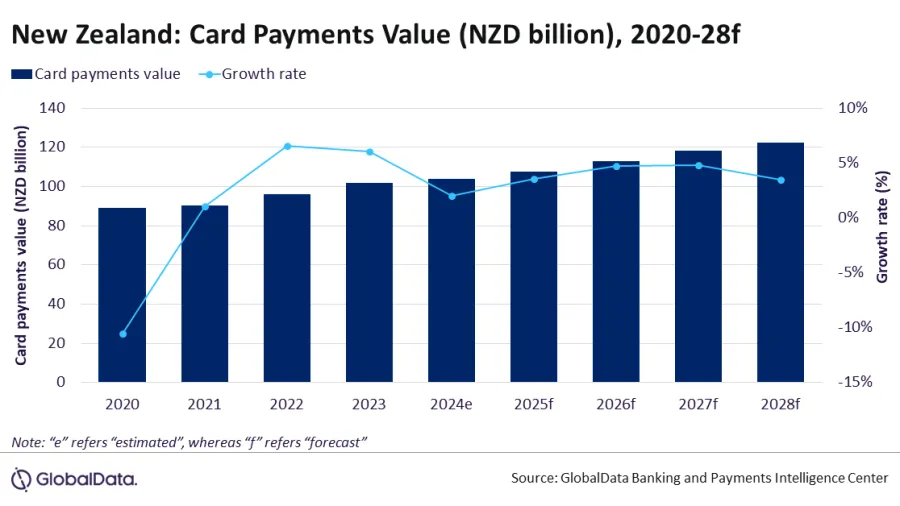

New Zealand’s card payments market is forecasted to be valued at $75.1b (NZ$122.3b) by 2028, on the back of a shift towards electronic payments, according to data and analytics firm GlobalData.

The market is expected to grow at a compound annual growth rate (CAGR) of 4.1% over the next four years.

In 2023, the New Zealand card payments market grew 6.1% to reach $62.6b (NZ$102b) in value.

Debit card payments account for nearly half of the total payment value in New Zealand, at 47.8%.

Credit and charge cards accounted for 52.2% share in 2024. This can be attributed to the value-added benefits offered by banks, such as reward points, discounts on purchases, and annual fee waivers, GlobalData said.

Advertise

Advertise