Chart of the Week: Taiwan’s card payments market value to hit $172.8b in 2026

Usage will rise to 64 uses per card per year, from 45 annual uses a card in 2022.

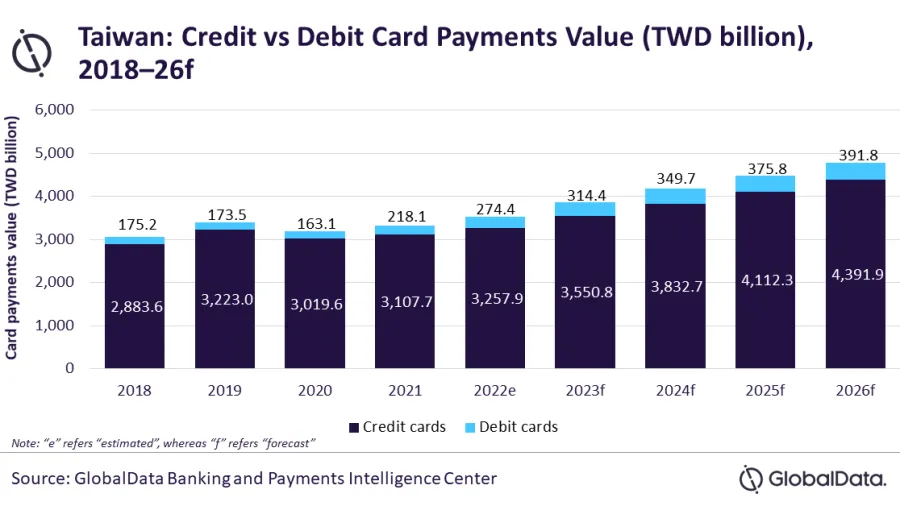

Taiwan’s card payments market is projected to reach $172.6b in 2026, thanks to growing preference for electronic payments, a surge in contactless payments, and local authorities’ efforts to boost cashless payments, reports data and analytics company GlobalData.

The market is expected to grow at a compound annual growth rate of 7.9% between 2022 and 2026.

Card payments value in Taiwan is estimated to be worth $127.5b by end-2022, or a 6.2% growth compared to 2021. This was thanks to improving economic conditions and a rise in consumer spending.

ALSO READ: Taiwan banks’ bad loans dropped to $1.86b

In particular, credit card usage is expected to rise to 64 per card a year by 2026, from the current average of 45 times a year in 2022. Credit cards currently make up 92.2% of card payments by value by end-2022. Debit cards occupy the remaining 7.8% of the market share.

“The number of credit cards in circulation in Taiwan is forecast to reach 65.6 million by 2026, increasing at a CAGR of 4.5%, whilst debit cards will grow at a CAGR of 4.2% to reach 139.8 million,” noted Kartik Challa, senior banking and payments analyst, GlobalData.

“The proliferation of digital-only banks is driving competition in the country’s banking space, thus helping boost debit card holding,” Challa added.

Advertise

Advertise