Chart of the Week: Thailand’s POS card payments gain ground as ATM use shrinks

But ATM card usage still dominated.

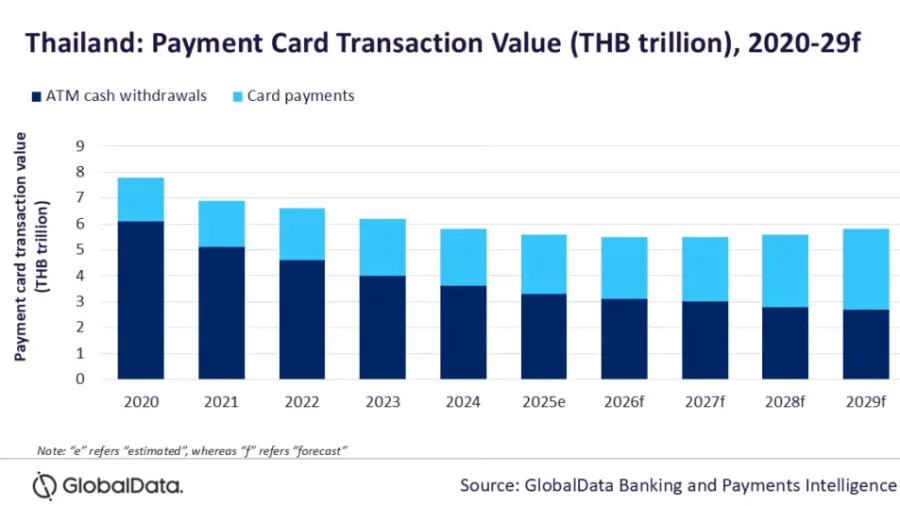

Thailand’s payment card transaction value— including point-of-sales (POS) payments and ATM cash withdrawals— is expected to reach $164.6b (THB5.8t) in 2029, according to estimates by GlobalData.

Card payments value in Thailand reached a compound annual growth rate (CAGR) of 7.1% between 2020 and 2024 to reach $63.6b (THB2.2t) in 2024.

In contrast, card usage for ATM cash withdrawals is decreasing, with a negative CAGR of 12.4% during the same four-year period.

Currently ATM cash withdrawals still outnumber card payments at POS terminals. ATM cash withdrawals represented 58.9% of the total payment card transaction value in 2025, GlobalData said.

“However, this phenomenon is gradually changing with this share continues to decrease due to the growing preference for digital payment methods, which offer greater convenience and security,” the data and analytics company said.

Card payments— at physical POS terminals and remotely— are increasing steadily, with its share estimated to reach 41.1% in 2025.

The growing adoption of contactless payment will also contribute to the overall card usage at POS, GlobalData said. It particularly noted the integration of contactless payment systems into the public transportation network, such as the Mangmoon card launched by Krungthai Bank and the Mass Rapid Transport Authority of Thailand.

Advertise

Advertise