Consumer spending to drive card payments in South Korea

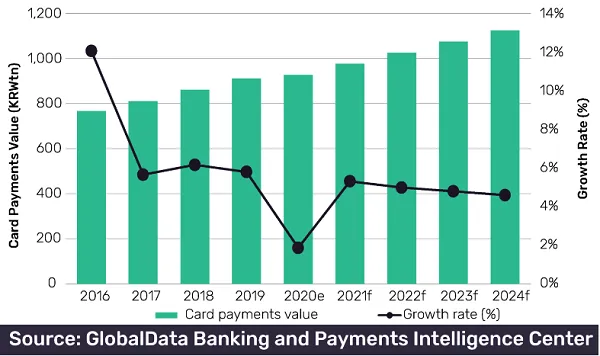

The sector is posed to grow at a CAGR of 4.3% from 2019 to 2024.

A surge in consumer spending amidst the easing of COVID-19 restrictions will fan the further rise of card payments in South Korea, according to a GlobalData report.

Card payment transactions in the country are expected to grow at a CAGR of 4.3% from $791b (KRW913t) in 2019 to $976b (KRW1.12t) in 2024. ATM cash withdrawals will see a 3% decline over the same period.

To prop up consumer spending, the South Korean government has granted emergency payout of up to$860 (KRW1m) credited to households’ credit card accounts in the form of points, which can be used for payments to select merchants but not for personal savings.

Advertise

Advertise