Mastercard pilots biometric payment authentication in India

Shoppers can use their fingerprint, face scan, or pin to confirm payment.

Mastercard has launched its Payment Passkey Service worldwide, enabling customers to use their biometrics to pay for online purchases instead of inputting passwords.

Payment Passkey Service is debuting first as a pilot in India, with payment aggregators such as Juspay, RazorPay, and PayU, banks such as Axis Bank, and online merchants like bigbasket participating in the pilot.

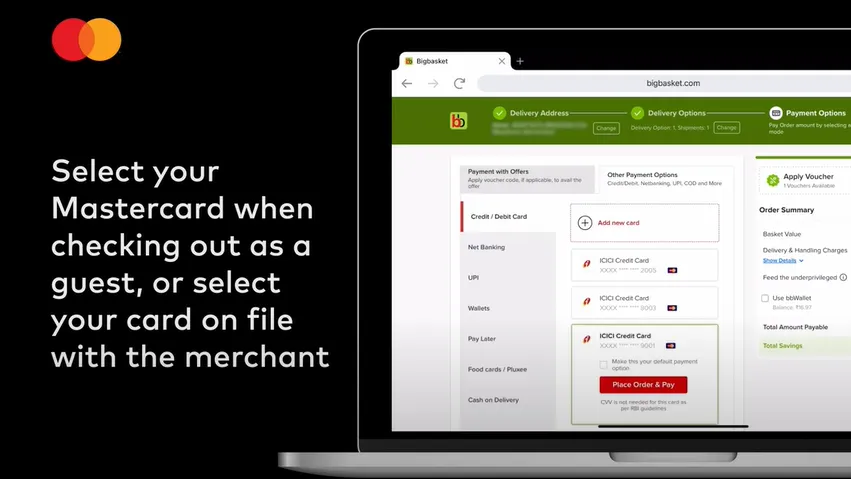

Shoppers need only to choose their Mastercard when checking out as a guest and select their card from the merchant’s list. To confirm payment, users will use their device’s biometric identification– a fingerprint, face scan, or a pin.

The service does away with one-time passwords (OTPs), which Mastercard say is vulnerable to online scams like phishing, SIM swapping, and message interception.

In India, fraud cases have surged by nearly 300% in the last two years, as reported by the Reserve Bank of India’s Annual Report for 2023-2024.

The Mastercard Payment Passkey Service is built for online or remote tokenized transactions, which today help significantly reduce fraud and increase approval rates. By combining the tokenization of payment credentials with seamless biometric authentication, Mastercard is bringing EMVCo, World Wide Web Consortium and the FIDO Alliance industry standards together to speed and secure the checkout experience.

Following the initial pilot program in India, Mastercard plans to roll out the biometric passkey service globally over the coming months.

Advertise

Advertise