Mobile tap payments produces least carbon emissions vs cash and ATMs: study

ATMs make up a bulk of carbon emissions, at 7.14g CO2e per transaction.

Mobile tap payments are the most eco-friendly way to pay, according to a white paper released by Japanese international payment brand JCB Co.

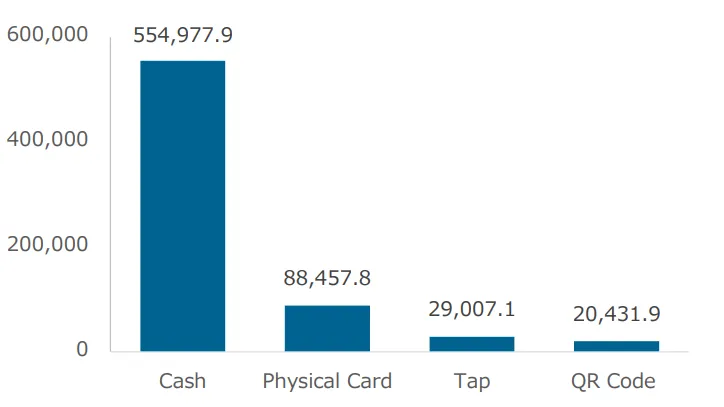

The study measured the carbon dioxide (CO2e) emissions from the production, lifecycle, and end-of-life of different payment instruments. JCB partnered with Your Arbor Inc. in making the calculations, making use of Japan’s total payments and cash data from 2022.

Mobile tap payments produced 4.93g CO2e per transaction, slightly lower than the physical card, which logged 5.33g CO2e per transaction. The IC chip component of the card made up the bulk of carbon emissions, at 5.32 g CO₂e per transaction on average.

Physical cash payments produced 10.57g CO2e per transaction. This takes into account ATMs, coins, and banknotes.

ALSO READ: How have banks’ wealth management pivots played out?

ATMs make up a bulk of the carbon emissions, at 7.14 g CO2e per transaction on average.

“The production and operational phases of the ATM influence the carbon impact of the cash payment method the most at 66.67%,” the whitepaper found.

Coins produce 2.41 g CO2e per transaction; whilst paper cash produces 1.01 g CO2e per transaction.

Calculations on card and mobile payments, meanwhile, involved averaging the CO2e of card materials used and the IC chip for the card or the materials used in a phone for mobile payments (with the base phone used being the iPhone 13 Max); and emissions from data centres.

Advertise

Advertise