S’pore’s payment cards lead with 40% market share in online transactions

An analyst said Singapore’s advanced tech infrastructure has boosted alternative payments.

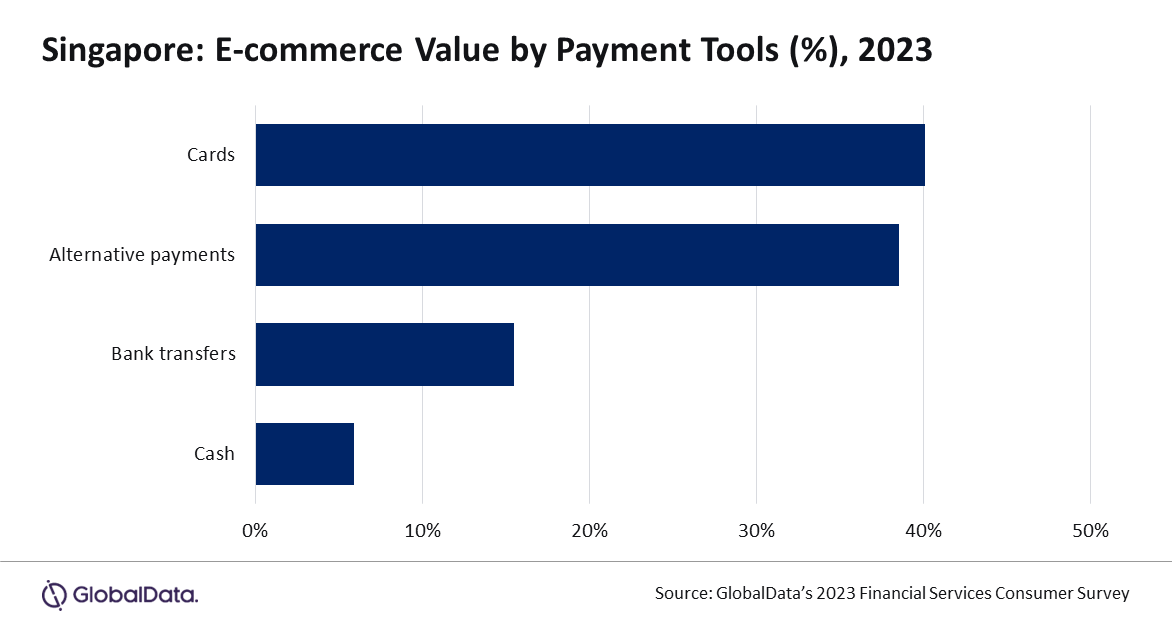

Singapore's payment cards continue to dominate, commanding over 40% of the market share for online transactions in 2023.

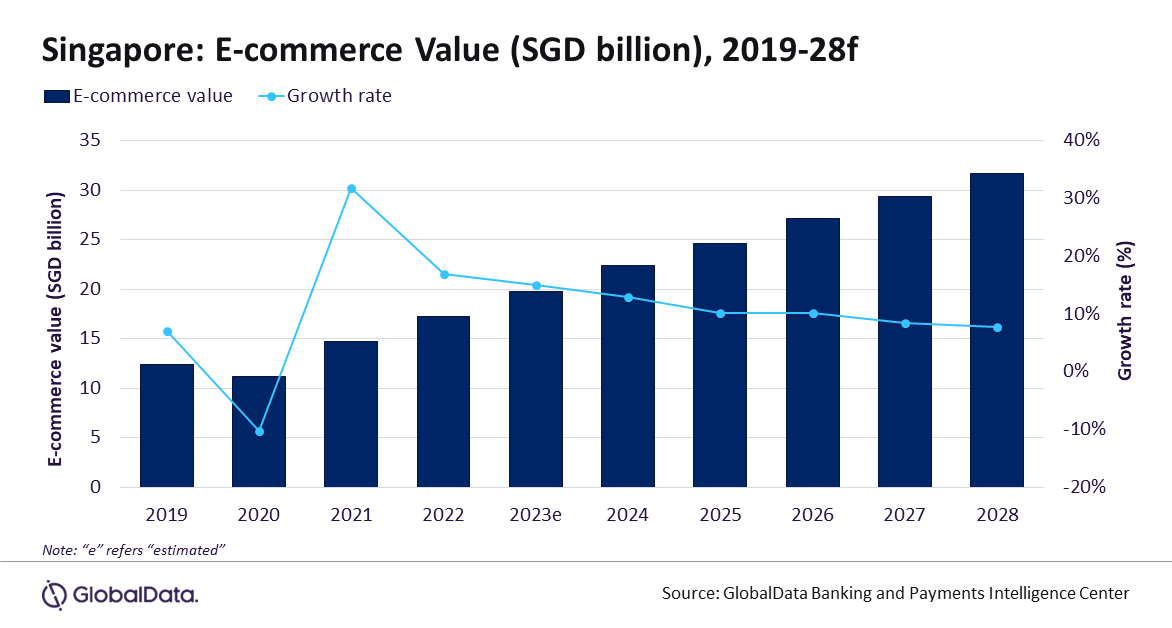

As consumers increasingly shift towards digital channels, fueled by advanced tech infrastructure and the growing adoption of alternative payment methods, the country's e-commerce market is poised for robust growth, expected to reach $22.3b in 2024, according to GlobalData.

“Singapore’s e-commerce market is well developed supported by the country’s robust technology infrastructure, which ensures the availability of high-speed internet, rising smartphone penetration, high urbanisation, and growing number of tech-savvy customers,” Poornima Chinta, Senior Banking and Payments Analyst at GlobalData said in a media release.

GlobalData's E-Commerce Analytics forecasts a compound annual growth rate (CAGR) of 9.1% between 2024 and 2028, projecting the Singapore e-commerce market to reach $31.7b by 2028.

The widespread internet and smartphone access, with 99% of households having internet access and 97% owning smartphones according to the Infocomm Media Development Authority (IMDA), lays down a solid foundation for e-commerce payments.

ALSO READ: SIA taps Mastercard for Southeast Asia loyalty card programs

Online shopping festivals like Black Friday, Cyber Monday, and the Great Singapore Sale further contribute to the e-commerce boom in Singapore.

Traditionally, payment cards have led e-commerce payments in Singapore, with credit and charge cards being highly favoured, accounting for a 31.9% share in 2023.

The appeal of credit and charge cards lies in their value-added benefits, including interest-free instalment payment options, reward programs, cashback, and discounts.

However, alternative payment methods are gaining ground as the second most preferred option for e-commerce payments, collectively accounting for a 38.6% share in 2023.

Bank transfers also play a significant role, accounting for 15.5% of total e-commerce transaction value in 2023.

Additionally, cash on delivery remains relevant, representing over 5% of e-commerce payments, underscoring the continued importance of cash transactions in the country's payment landscape.

“As Singapore’s e-commerce market continues to flourish, millennials and Generation Z are rapidly embracing the convenience and flexibility of alternative payment methods, which are set to challenge the dominance of payment cards in near future.” Chinta concluded.

Advertise

Advertise