What do corporate treasuries need from banks today?

The majority want a simple, real-time dashboard but may not have the budget or skills.

Treasurers desire real-time dashboards and instant information access from their treasury service providers, according to a study by HSBC.

"For some firms, the end goal may be instant payments, while others chase more efficient cash pooling or predictive insights into interest rate changes, FX rate movements, funding opportunities and cash flow needs at different branches of stores or subsidiaries," HSBC said in the report, "Redefining Treasury Asia Pacific."

The majority want simplified, real-time dashboards for instant access to information that is critical to decision making, with as little manual data collection and processing as possible, the study continued.

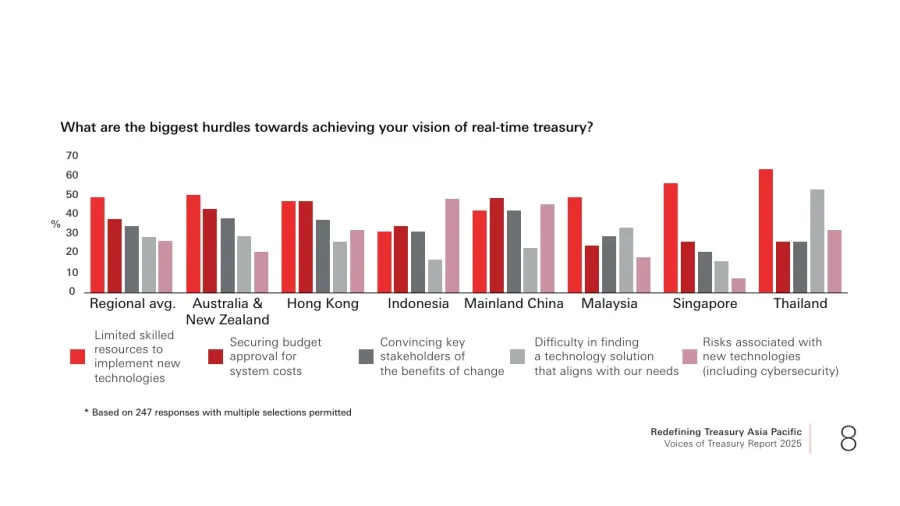

Across markets in the Asia Pacific region, the top hurdle named for real-time treasury was limited skilled resources to implement new technologies, according to 247 responses permitting multiple selections.

Only China and Indonesia had another top reason. For China, securing budget approval for system costs is the biggest challenge; in Indonesia, it's convincing stakeholders of the benefits of change.

More companies want to be able to manage their cash in real time in the face of a global trade war that could snarl financial planning, disrupt supply chains, and raise costs, HSBC had told Asian Banking & Finance in an interview earlier in 2025.

“The faster you can act in response, the more you can mitigate evolving external policy changes,” Patrick Zhu, managing director and regional head of corporate sales for the Asia-Pacific region at HSBC Holdings Plc’s Global Payments Solutions, said at the time.

To meet real-time treasury needs and global cash visibility, banks are turning to tokenization and automation. Citi, for example, has launched several initiatives including the Citi Token Services, Real-Time Funding, and 7-Day Sweeps in a bid to help companies optimize their cash positioning and cut operational friction.

Advertise

Advertise