Modelling, simulation key to powering businesses forward in an everchanging macro-economic, geopolitical, and ESG landscape

Converging business with technology can improve profitability and performance.

To achieve business growth and performance in their sustainability journeys, entities must leverage simulation modelling that reflects present and future data, according to Kiran Mistry, Head of Financial Services - Asia Pacific & Japan of SAP, during a roundtable discussion organised by Asian Banking and Finance magazine.

The main advantage of running what-if scenarios and simulations in any organisation is to gain actual insights and possibilities for the future and to improve decision-making. As a result, simulations that consider comprehensive risk factors enable organisations to find solutions that improve profitability, performance, and sustainability.

Mistry added that “simulation modelling is not tweaking the models from yesterday to address today's complexity,” adding that the more factors and combinations added into the mix, the easier it will be to identify potential impacts on portfolios and customers.

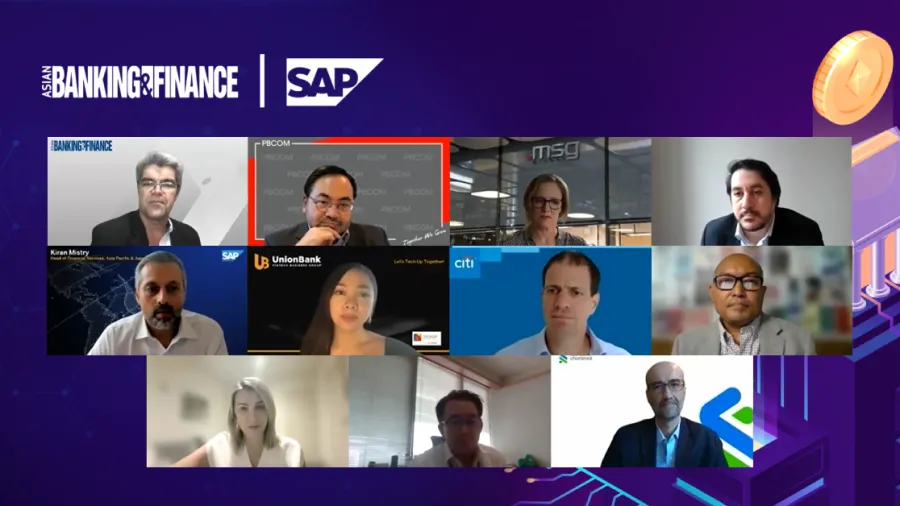

The roundtable, in partnership with business solutions company SAP, provided an insightful discussion on driving business success with profitability, performance, and sustainability.

Asia Banking and Finance magazine contributing editor Simon Hyett hosted and moderated the virtual event, which was attended by top executives from premier banking, financial services and solutions companies such as Louise Cooke, Executive Board Member at msg global solutions; Gaurav Bagga, CFO for Singapore and ASEAN markets, Standard Chartered Bank; Ana Marinkovic, Executive General Manager, National Australia Bank (NAB); Erika Dizon-Go, Senior Vice President, FinTech business group head, Open Finance and Digital Services Center of Excellence Head at Union Bank of the Philippines; John Howard Medina, Executive Vice President and Chief Operations at Philippine Bank of Communications (PBCOM); Crispian Cuss, APAC Head of Sustainability & ESG at Citibank; Win Lwin, Advisor to the chairman and former CEO of Farmers Development Bank (FDB), Myanmar; Hicham Kabir, Head of Sustainable Finance, PwC; and Kiran Mistry, Head of Financial Services, Asia Pacific and Japan at SAP; and Naruetep Chokjrenwanit, SVP Credit Risk, Bangkok Bank Public Company Limited Thailand.

Everything in the mix

In recent years, governments, international organisations, and businesses have established sustainability goals whilst keeping growth and performance in sight. Despite the great strides in their respective initiatives, challenges remain in following a comprehensive simulation model, not only from policy changes within governments, banks, and regulators, according to Marinkovic (NAB). Marinkovic added that aside from the policy changes, we've got to consider our supply chains and the environmental risks of extreme weather such as flood, fire, wind storms, and drought. She adds, as businesses, banks also face intrinsic financial risks from an acquisition perspective, where banks need to ensure customers can meet financial responsibilities such as repaying loans and running sustainable enterprises.

To add to this mix, Mistry (SAP) threw in “the macroeconomy, the war, the pandemic supply chain issues, climate issues, and then couple that with complex financial instruments and complex financial portfolios, and then adding ESG into that mix; there's just so much in there for businesses to comprehend with.” He adds, “We need to build a business for the future, taking stock of what you need to model and simulate.

The Importance of Simulation

Bagga (Standard Chartered Bank) and Mistry underscore the importance of performing scenario analysis to simulate the impact of risk factors for the next 10 to 15 years and what businesses need to do before disaster strikes.

One example of how not to do it was showcased by the fall of Silicon Valley Bank (SVB) “With the geopolitical and macro-economic factors driving up inflation, the federal reserve hiked interest rates to curb it. Prior to this, SVB had purchased a lot of bonds and mortgage-backed securities when interest rates were very low. These assets were exposed to those rising interest rates as the Fed attempted to curb inflation. This resulted in SVB amassing around $15b worth of losses through that,” Mistry cited.

Mistry said, “What SVB should have done was have a more comprehensive way of modelling and simulating the various factors that impact their asset portfolio. “The more factors, the more factor combinations, the easier it will be to identify potential impact on those portfolios and those customers. Simulation modelling is not tweaking the models from yesterday to address today's complexity.”

To address these ever-changing complexities, simulation is a must. Bagga likens it to financial institutions solving a Rubik’s Cube. “When you move one lever of that Rubik’s Cube, you end up having to throw out five or six other levers at the same time. Simulation throws up a set of variables and flexes a number of different things holistically. This then starts to spit out some answers and actionable outcomes on what the entire organisation can do to optimise performance,” he said.

An alternative view to this provided by Union Bank’s Erika Dizon-Go believes data science is one of the best approaches to making the right business decisions and understanding the data completely, making sure to check with the customers to understand their specific pain points.

“If you don't understand those you serve, then there is no sustainability, there is no growth. We'll just be stuck with the same business models and the same use cases.”

PBCom’s Medina revealed that in the Philippines, the Central Bank mandated the environmental social risk management framework two years ago, prescribing banks use simulations to manage credit risk from a sustainability perspective, testing scenarios for environmental social risks, and scenario analysis for sustainability risks. From an operational risk perspective, banks are mandated to conduct operational feasibility tests.

“Simulation is not something we have a choice at, which is a good thing because it gives all the banks guidance in how to approach managing ESG risk,” he said.

For her part, Cooke emphasised the need for technology to enable such analysis and explained that her team uses SAP PaPM to analyse large volumes of data to establish key performance indicators (KPIs) and create the transparency needed to meet regulatory compliance requirements. From that starting point, simulating what-if scenarios is just a small step away.

Impact on Business

As in most things, adopting simulation modelling has been slow.

“It's been a gradual change, but the fundamentals of business are still the same,” said Citibank’s Crispian Cuss, particularly regarding meeting clients' and stakeholders’ needs.

To help clients with that shift, banks and financial services businesses have embarked on a mission to own the risks and have very honest conversations with clients, he said. He added responsibility includes upskilling banking and finance professionals because “a lot of clients aren't going to have the ambition nor the capability to do it in the needed time frame to achieve net-zero targets.”

Some businesses that adopted simulation modelling, such as PwC, have enjoyed a more holistic approach to decision-making that incorporates ESG factors into strategic planning, risk management, and product development, said Hicham Kabir (PwC).

“By leveraging advanced technologies such as SAP technologies and tools, we have been able to better manage ESG risk and opportunities for our clients, streamline reporting, and align with industry standards,” he noted.

A Balancing Act

Balancing asset portfolio monitoring with an investment strategy can be tricky. For instance, banks considering lending to a company must perform due diligence and risk assessments on their supply chain. But more steps to comply with tightening ESG-related regulations are resulting in more costs.

There might not be a choice. In Thailand, Chokjrenwanit (Bangkok Bank) revealed that the main driver to obtain ESG competencies comes from manufacturers or exporters that are concerned with being slapped with sanctions, especially from European countries, for non-compliance.

Myanmar’s highly volatile environment also presents a different challenge to sustainability simulation modelling.

Win Lwin (FDB) delved into the risks that make it nearly impossible to simulate or forecast sustainability results: a military coup, skyrocketing inflation, soaring energy prices, and the eventual exit of foreign investors.

In this kind of environment, he lamented that the focus is mainly on survival and that there is no intrinsic drive in the banking industry to drive sustainability in the absence of proper regulatory requirements. This is evidenced by the lack of oversight committees or supervisory channels around regulatory compliance.

In such a scenario, Marinkovic underscored the importance of staying empathetic and in touch with reality. “We just need to think about how the global banking industry, which is very well equipped to have an impact globally, and countries like Australia can potentially lead the way and inspire but also do the grunt work whilst other countries are fighting other battles that are just as important.”

On whether the banking industry can create that sort of impetus and momentum on sustainability issues, Bagga said, “Where banks are able to, we really must continue to do that, whilst recognising that there is a different appetite in every market that we operate.”

To achieve that balance between asset monitoring and investment strategy, Mistry believes that business leaders can achieve better management through a strong, sophisticated technology platforms that enable dynamic modelling on multiple factors that reflect the present environment.

Platforms such as SAP’s Profitability and Performance Management (PaPM) offer the flexibility to model complex situations and process millions of records from various data sources in real-time, giving business leaders the power to make the right decisions, whether it's investing or monitoring.

“The ideal situation,” Cooke (msg global solutions) said, “is that we can all improve our sustainability footprint whilst also reducing expenses. So we can create win-win situations that both improve the bottom line but also improve sustainability.”

“In the end, banks going on a journey with the client will find ways to innovate to make (it) work for them in a sustainable fashion,” Bagga added.

Advertise

Advertise