ZA Bank

ZA Bank is one of the first virtual banks in Hong Kong. It was first license by the Hong Kong Monetary Authority on 27 March 2019. It officially opened its virtual doors to the public on 24 March 2020 and is one of the first fully-operating virtual bank in Hong Kong.

See below for the Latest ZA Bank News, Analysis, Profit Results, Share Price Information, and Commentary

Hong Kong’s ZA Bank offers crypto trading services to retail users

Hong Kong’s ZA Bank offers crypto trading services to retail users

Global crypto market capitalization has surged 90% to over US$2.3t.

ZA Bank commences pilot for virtual asset trading service

Three in four Hong Kong investors are interested in investing in cryptocurrency.

ZA Bank debuts business banking referral programme

Users can invite companies to register and get a HK$288 cash reward.

Hong Kong to rename ‘virtual banks’ to ‘digital banks’

The bank will set-out new guidelines shortly.

ZA narrows net loss, sees 46% net revenue rise in H1

Total assets and net interest margin grew during the first half of 2024.

ZA Bank unveils foreign exchange time deposit

Users can access it via the deposit page in the ZA Bank app.

ZA Bank cuts installment loan interest rate

Applicants get a cash reward of up to $188.6 until 30 September.

Hong Kong’s ZA Bank achieves monthly net profitability

The bank has over 800,000 users in the city.

HKMA rules out new virtual banking licenses

Competition is keen in the market and enquiries have declined.

ZA Bank enables users to earn 8% p.a. Savings rate by walking daily

Users must complete fitness challenges in August.

ZA Bank rolls out reserve banking services to stablecoin issuers

It has on boarded RD InnoTech and is onboarding 10 other issuers.

Hong Kong’s ZA Bank unveils stock rebate programme

Users can also collect a big-name US stock worth up to $77.77.

ZA Bank’s Devon Sin on why Web3 is key to HK’s growth

The bank has expanded services to cater to stablecoin issuers and Web3 companies.

ZA Bank unveils business loan for Global Payments merchants

The virtual bank examines credit health based on business activities, amongst others.

Hong Kong’s ZA Bank kicks off dedicated banking services for stablecoin issuers

The bank has surpassed $1b in transfer turnover to Web3 clients.

ZA Bank rolls out tax loan, offers cash rewards

Even unsuccessful loan applicants can receive a reward.

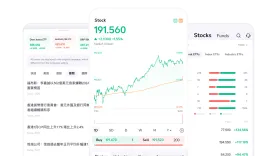

Hong Kong’s ZA Bank to roll out US stock trading services

The Hong Kong SFC has lifted previous conditions to the bank's securities license.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership