Hong Kong banks lose top talent with drawn-out hiring steps

Hiring rose 2.5% among 15 lenders in Asian Banking & Finance’s annual survey.

Banks in Hong Kong should streamline their application processes and reconsider language requirements if they want to hire and retain the top talent, recruitment experts told Hong Kong Business.

More selective and longer hiring timelines are hurting banks’ ability to attract workers, said Robert Sheffield, managing director for China and Hong Kong at Ireland-based recruitment consultant Morgan McKinely.

“We're seeing a number of [top-tier candidates] take opportunities with competitors that offer a more streamlined and efficient hiring experience,” he said via Zoom. Skilled workers in high demand are less likely to go through a longer interview process, he added.

Applicants often have to complete cognitive, personality, and behavioral tests to help predict job performance, along with the need to provide detailed references. Hiring managers are also evaluating soft skills and emotional intelligence and how workers will fit the company culture.

They also face several layers of interviews with compliance and risk departments, and detailed documentation in each hiring stage, Sheffield said.

The long hiring process comes with stricter regulatory scrutiny in the past two years.

“Banks are under an enormous amount of pressure to ensure compliance, and you’ve got increasingly complex regulations related to anti-money laundering, artificial intelligence (AI), know-your-customer (KYC) procedures, and data privacy,” he pointed out.

Banks have been hiring more people in KYC, asset liability and regulatory risk management, including credit, market, and operational risks, and anything tech-related, according to British recruitment company Robert Walters Plc.

"Relationship managers continue to be in demand, especially those with “strong client networks,” said Elaine Chu, senior manager of financial services at Robert Walters Hong Kong.

It’s not just banks that are cautious. Job candidates have also started to consider bank stability before jumping ship, she pointed out.

“We’re seeing a lot more candidates who have been more reserved than they were, but also because the [pay hike] increments have become smaller as well,” she said via Zoom.

Meanwhile, lenders in Hong Kong might have to stop requiring job applicants to speak Mandarin, at least for some roles.

“When you actually look at the roles that they’re talking about, the majority of those people will speak English,” Sheffield said.

“There are a number of institutions that we work with where that process is probably three, four times longer than it was, and it's because of a mandate on Mandarin.”

“When you drill down into that, they cannot justify why it's there,” he added. Sheffield said about 70% of Hong Kong’s talent pool comes from Mainland China.

Chu said most banks in Hong Kong are adjusting their hiring methods instead of reducing. “[For some], the seniority has changed. If a vice president leaves, they might hire an assistant vice president, and if an assistant vice president leaves, they’ll hire an associate.”

“We are seeing a lot more internal applicants—direct applicants from the banks themselves,” she added.

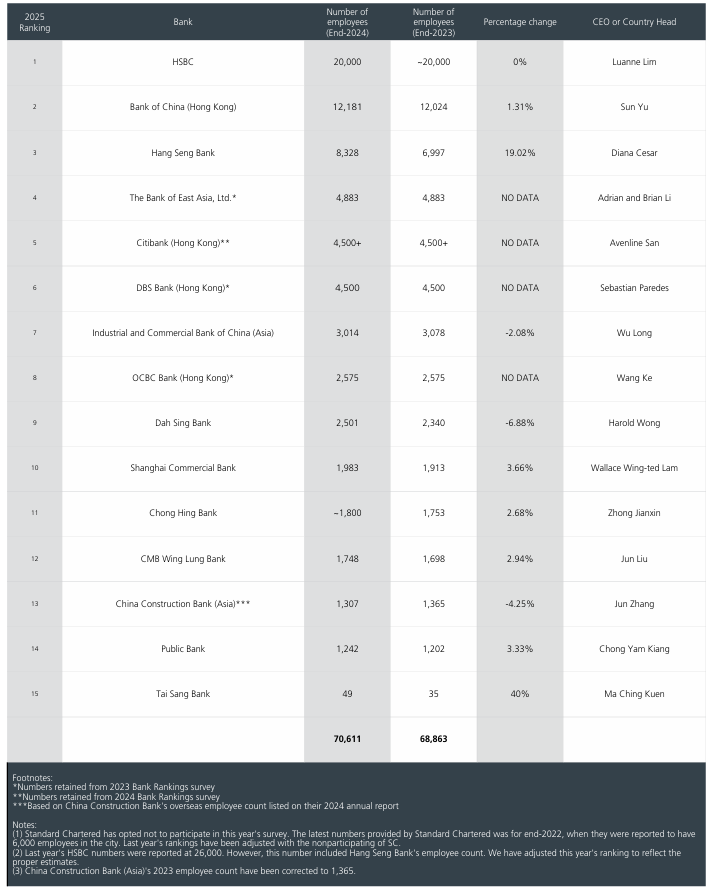

The banking industry hired more than they cut last year, with 15 banks adding 2.5% more workers to 70,611, according to the latest bank ranking survey by Asian Banking & Finance. This is faster than the 0.16% growth in 2023 covering the same 15 banks plus Standard Chartered Bank Plc, which did not participate in this year’s survey.

Tai Sang Bank Ltd., Hong Kong’s smallest lender, and homegrown Hang Seng Bank, owned by The Hongkong and Shanghai Banking Corp. Ltd. (HSBC), logged the fastest hiring growth at 40% and 19%.

Hang Seng Bank added more than 1,300 people to 8,328, whilst Tai Sang increased its headcount by 14 to to 49.

The Asia-Pacific unit of HSBC Holdings Plc continued to be the biggest employer in Hong Kong’s banking sector with about 20,000 workers, the same as in 2023.

Apart from Hang Seng Bank and Tai Sang Bank, five other lenders hired more last year—Bank of China (Hong Kong) Ltd., Shanghai Commercial Bank, Chong Hing Bank, CMB Wing Lung Bank, and Public Bank (Hong Kong) Ltd.

Dah Sing Bank, one of the two remaining family-owned banks in the city, reported the fastest job cut of 6.9%.

Industrial and Commercial Bank of China (Asia) and China Construction Bank (Asia) also had fewer employees, the latter based on the overseas worker count in its annual report.

IPO jobs

Chu cited the rise of contract hiring not just in the banking sector but across all sectors, whilst pay hikes were lower.

“Most of the increments are around 10%–15%,” she said. “Realistically, during a good market, we’re looking at approximately 20%.”

Sheffield said automation is starting to affect banks’ hiring attitudes.

“A lot of outsourcing and offshoring and generalist roles without specific in-demand expertise are being removed from organisations,” he said, citing the use of generative AI in the middle and back offices.

Hiring by investment bankers was slow as global deal volumes remained subdued, he pointed out.

“There is demand for top-performing deal makers, and there’ll be aggressive hiring sprees on occasion, but that’s going to be far less prevalent,” Sheffield said.

Chu said positions related to initial public offerings (IPO) have been opened amidst a listing resurgence.

In the first half, Hong Kong’s IPO proceeds were projected to have jumped more than eightfold to $108.7b (US$14b) from a year earlier, accounting for 24% of the total globally and putting it at the top spot, according to data from Ernst & Young Global Ltd. (EY).

Mainland Chinese companies seeking to unlock growth via dual listing are driving the city’s listing revival, it said.

The Hong Kong IPOs of several A-share listed companies or their spin-offs boosted the average proceeds by more than fivefold year on year, EY said in a June report.

The average IPO proceeds during the period ranked second among all first-half periods in the past decade, only trailing behind the exceptional performance in 2021, it added.

Advertise

Advertise