Bank of China

The Bank of China is a Chinese majority state-owned commercial bank headquartered in Beijing and the fourth largest bank in the world.

See below for the Latest Bank of China News, Analysis, Profit Results, Share Price Information, and Commentary.

CMB seen as top winner in China’s wealth reallocation, CGSI says

CMB seen as top winner in China’s wealth reallocation, CGSI says

CGSI expects the bank to benefit from stronger demand for wealth management and bancassurance products.

BOCHK capitalisation strong but property risks remain

Fee income and treasury income will support its profitability through mid-2027.

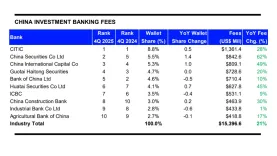

CITIC leads China investment banking fees as market hits 3-year high

It retained its position as the top financial institution in terms of IB fees raised.

BOCHK partners with Manulife to launch multi-asset income solutions

It will draw on global income sources such as preferred securities and others.

Automation stalls hiring at Singapore’s top banks

Lenders are also upskilling to keep up with tech.

BOC International’s investment risk is limited, profitability stable: report

Its brokerage income has remained stable in the pats 4 years.

Chinese megabanks cement nation’s economic prowess

Banks in China dominated S&P Global Market Intelligence’s top 50 lenders in the region.

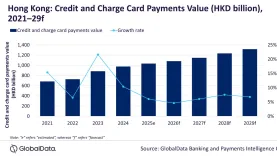

Chart of the Week: HK credit and charge card market to reach $132.4b

Banks are rolling out new services, such as a mobile virtual card and a dual-currency card.

Chinese state banks’ enhanced policy roles increases support prospects

Banks are expected to log moderate credit growth and no increase in risk appetite.

Global Top 25 banks market cap up 20.1% to $4.7t; China Big 4, DBS rise

HSBC also recorded a double digit increase in its market cap.

China’s Big 5 banks expected to boost lending with capital support

Fee income may also recover if new stimulus policies are effective, said CreditSights.

Bank of China Hong Kong stays resilient with buffer against CRE risks

S&P anticipates moderately slower asset growth.

China’s ICBC still world’s most valuable bank brand: study

Brand value went up 10% during the year.

Top 25 banks’ market cap rises 27.1% in Q4 2024

ICBC is APAC’s top bank in terms of market cap; DBS rises to 23rd spot.

Global banking industry faces headwinds amidst shifting monetary, political landscapes: BOC

It is expected to see pressures on profit growth and uneven expansion.

Chinese banks set up offices at Dubai International Financial Centre

About 8 banks from China now have locations in the financial centre.

China's financial sector intensifies efforts to stabilise economy

The transformation of the monetary policy framework has also accelerated.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership