Here's why wealth management will be Singapore banks' cash cow in 2013

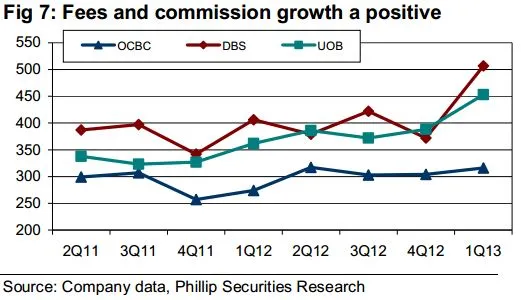

DBS and UOB posted record-high Fees and Commission.

According to Phillip Securities Research, Wealth Management fees was a strong growth driver for the three banks. Due to a few oneoff large fees relating to the large loans transaction, coupled with strong performances from wealth management, DBS and UOB posted record-high Fees and Commission.

Here's more from Phillip Securities:

Fees and Commission to grow further – As client relationship further develops, and affluence in the region continues to increase, we expect this to drive growth. The strong value proposition, through the range of treasury, wealth, and bancassurance products that the banks offer, is expected to further drive growth in this segment.

While Fees and commission currently constitute a smaller proportion of the bank’s total revenue relative to net interest income, we expect this to grow in importance. This is especially since it is less capital intensive and thus favored in view of high Basel III capital requirements. UOB expects 15% y-y growth of Fees and Commission for FY2013.

Advertise

Advertise