SG AI fintechs score funding wins amidst fintech investment downturn

This bucked the global trend, where AI fintechs overall clinched less investments.

2023 was a stellar year for Singaporean fintechs exploring artificial intelligence (AI) technologies, with funding to the sector rising 77% in the last six months of the year.

AI fintechs amassed $333.13m in funding during the latter half of 2023, compared to $148.08m in H1, according to data from the KPMG.

This meant that total AI sector investment equaled nearly half a billion dollars across 24 deals in Singapore during the year.

In contrast, global fintech investments in the AI subsector slowed to just $12.1b in 2023 from $28.1b a year earlier.

However, this may simply be due to financial institutions and fintech firms worldwide opting to form strategic alliances and product expenditure to harness the power of AI, rather than make direct investments, KPMG said.

Decreasing fintech investments

Whilst AI fintechs scored big deals last year, the same could not be said for the whole fintech sector overall. Investments to fintechs plunged 68% to just $2.2b raised in 2023, from $4.4b raised in 2022.

Deal activity also saw a sharp decline, with only 189 in 2023– half of what was reported a year earlier, KPMG said.

The downward trend was pronounced in the last six months of 2023. Whilst AI fintechs saw investments double, overall funding fell to just $747m across 87 deals. In comparison, in H2 2022, Singapore fintechs clinched $1.45b in investments across 102 deals.

This marks the slowest performance for fintech funding since the COVID-19 year of 2020, when only $1.13b was raised across 183 deals, KPMG noted.

“The dampened investor sentiment can be attributed to geopolitical conflicts, a high interest rate environment, and a lackluster exit environment across regions, which prompted fintech investors to exercise caution and conserve their cash reserves throughout 2023,” KPMG said.

There is also an increased focus on profitability, noted Anton Ruddenklau, global head fintech and innovation, financial services, KPMG International.

“Whilst it was a depressed year for the fintech market overall, there were a few particularly bright lights. Proptech, ESG fintech, and investors embraced AI-focused fintechs—which helped particularly in the last six months,” Ruddenklau added.

“Furthermore, the increased scrutiny of potential fintech deals, with an emphasis on profitability and avoidance of down rounds, further shaped the funding landscape in 2023,” he noted.

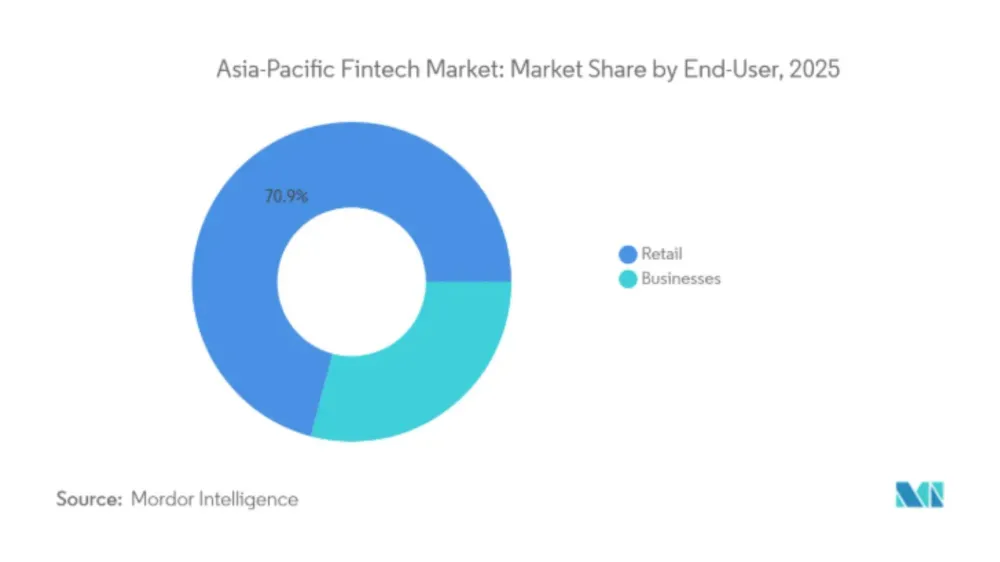

Singapore is APAC’s top fintech hub

Despite amassing lower investments, Singapore still emerged as a leader in the APAC, accounting for 21% of all fintech deals.

Notable deals include a $359m funding raise by ANEXT Bank; and a $246m fundraising by insurtech firm Bolttech.

There were a total of 74 deals closed involving early-stage companies; and 63 seed funding rounds.

Advertise

Advertise