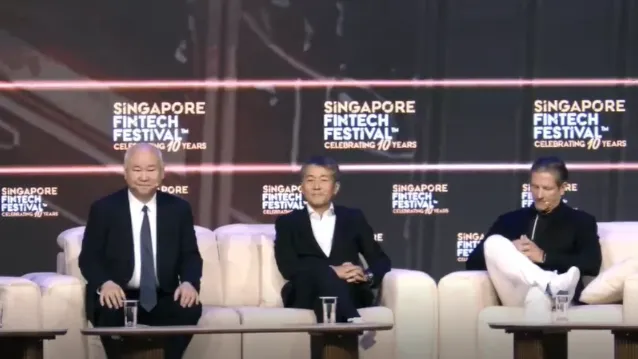

AI governance, quantum threats dominate Singapore FinTech Festival Day 3

Executives say resilient digital architecture, not breakthroughs alone, will shape the next era of finance.

Day 3 of the Singapore FinTech Festival 2025 made one point clear: the next phase of finance will be defined less by technological breakthroughs than by the architectures, safeguards, and cross-border systems needed to support them.

Ravi Menon, chairman of the Global Finance & Technology Network, said the financial sector is entering an era built on foundational digital infrastructure such as trusted data platforms, programmable money, digital identities, and electronic payments. But their value, he stressed, will hinge on governance that can keep pace with deployment.

Monetary Authority of Singapore's (MAS’) latest consultation paper on AI Risk Management Guidelines reflects this shift.

Goh Gek Choo, the executive director leading the work, said financial institutions are seeking clearer guardrails as AI moves deeper into credit scoring, monitoring, and customer engagement. Strong governance, she noted, is becoming a prerequisite for both confidence and innovation, not simply a regulatory demand. Institutions only scale new technologies when they trust the underlying architecture not to expose them to systemic or reputational harm.

Even as regulators set clearer expectations, innovators are pushing ahead. Paytm founder Vijay Shekhar Sharma showcased an AI-powered point-of-sale device being piloted in India. Designed to surface real-time insights from merchant transaction data, the device acts as a virtual operating executive—providing operational answers, performance trends, and even live translation during negotiations. Early usage suggests embedded intelligence could materially reshape how small businesses operate in emerging markets.

Quantum-resilient infrastructure

Although quantum computing remains nascent, experts warned that its cryptographic impact is not. MAS Assistant Managing Director Vincent Loy urged institutions to begin “no-regrets moves”: identifying cryptographic keys, assessing vulnerabilities, and preparing for rapid migration. The risk is already active, he noted, even if the timeline for quantum scale-up is uncertain.

Camilla Bullock, CEO of the Emerging Payments Association Asia, reinforced the urgency with the rise of “harvest now, decrypt later” attacks—criminals stealing encrypted data today in anticipation of future quantum decryption.

DBS Chief Data and Transformation Officer Nimish Panchmatia said quantum readiness is ultimately a trust issue. A breach in cryptographic integrity would cut at the core value proposition of banking.

Regulators echoed these concerns. Colin Payne, head of innovation at the UK Financial Conduct Authority, likened waiting for quantum disruption to waiting for a car crash before putting on a seatbelt. Quantum-safe systems and agile cybersecurity will be central to long-term resilience, he said.

Cross-border digital systems

Japan featured prominently in discussions on regional fintech expansion. In the “Japan’s FinTech Frontier” session, foreign players said the market has become more attractive due to cautious but consistent regulatory discipline. Bolttech Group CEO Rob Schimek described Japanese consumers as digitally sophisticated and demanding of high data-security standards, backed by one of the region’s most rigorous regulatory regimes.

India’s digital public infrastructure (DPI) also remained a touchpoint for scalable transformation. Its model, combining public rails with private-sector innovation, continues to anchor interoperability across services.

For small and medium-sized enterprises, however, structural barriers persist. Helena Forest, Mastercard’s EVP for Real Time Payments, highlighted how real-time payment rails have brought more than 8 million Thai SMEs into the formal economy across 12 markets. But Milind Sanghavi, founder of XWeave.io, noted that SMEs still face high transaction costs and fragmentation. In one case, a startup paid 65 basis points for a simple transfer—illustrating how infrastructure gaps still burden smaller enterprises.

Sanghavi said progress will depend on closer alignment between regulators, financial institutions, and digital-asset ecosystems. Extending the industry’s historically high level of collaboration into areas such as institutional digital assets and next-generation payments will determine whether commercial adoption can scale sustainably.

Advertise

Advertise