Chart of the Week: Almost half of Singaporeans prefer e-payment methods

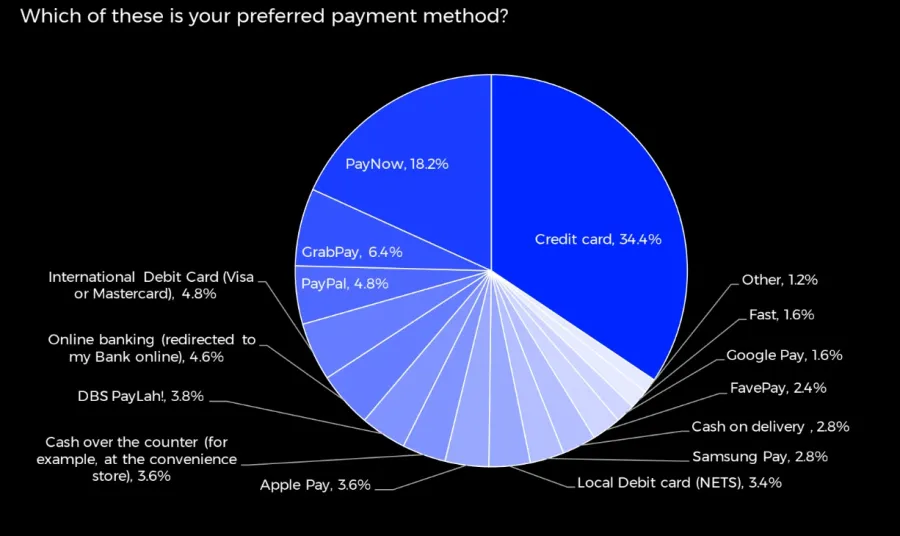

PayNow is the top choice for 18.2% of surveyed consumers.

Whilst credit cards continue to dominate the e-commerce payments landscape in Singapore, the use of real time bank payment services and e-wallets are on the rise, with 42% of local consumers preferring these methods of payments online, a survey by payment network company Rapyd revealed.

Credit cards continue to be the top-most preferred payment method for online purchases, with 34.4% of the survey’s 500 respondents indicating such. Around 75% of the respondents also used a credit card for paying goods both online and offline in the months of March and April.

But national real-time e-payments scheme PayNow is rapidly closing the gap, with 18.2% of Singaporeans now naming it as their preferred payment method. The number of respondents who used the payment method for online and offline purchases over March and April now stands at 70%.

Meanwhile, 6.4% of the total respondents said that GrabPay is their preferred payment method, followed by PayPal with 4.8% saying that they favour this service.

Bank transfers and e-wallets are also gaining ground in the city. Around 43% of respondents used mobile banking to pay for goods and services online and offline in March and April. Over the same period, 44% used PayPal and 43% used DBS PayLah!

Other e-payment methods used were Apple Pay (20%), FavePay (19%), Google Pay (11%), Singtel Dash (10%), OCBC Pay Anyone (10%), and Samsung Pay (9%).

Singapore currently boasts of an e-commerce market value of $4.9b, according to a separate study by J.P. Morgan, whilst it has a mobile commerce market value of $2.1b. By 2021, e-wallet purchases are expected to make up 22% of all sales in the city.

Advertise

Advertise