Bank International Indonesia sure to meet target of $943M auto loans

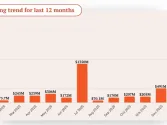

Bank International Indonesia Finance Center expressed confidence that it will meet its target to boost outstanding loans to Rp 9 trillion ($943 million) next year.

The figure is a 33 percent increase from an estimated Rp 6 trillion in 2011.

Bank International Indonesia Finance Center is the auto-financing arm of Bank International Indonesia,

The Finance Ministry introduced the regulation in mid-June, requiring car buyers to make a minimum down payment of 25 percent of the sale price for loans from financing companies, and 30 percent if the loan is from a bank.

Previously, there were no rules, and sellers often required about 15 percent for down payments. The regulation was introduced to prevent an increase of non-performing loans for vehicle purchases. About 70 percent of car purchases in Indonesia are financed by loans.

Alexander, BII Finance Center president director, said that the average down payment in the company after the rule was implemented was 34 percent, up from an average of 30 percent beforehand.

The average, he said, reflected the company’s target market, which is the middle class.

He said that BII Finance Center wants to disburse Rp 5 trillion in new loans this year for 40,000 cars. The target is likely to be reached because from January through August, the company already disbursed Rp 4 trillion.

For more.

Advertise

Advertise