Thailand's BAY prioritizes e-banking over branch growth

Changing lifestyles and financial behaviours.

These were the considerations why Bank of Ayudhya is focusing on electronic banking development rather than branch expansion.

BAY is cutting back on aggressive branch expansion to concentrate on e-banking development.

Still, BAY plans to add new 50 branches across the country next year to its existing 600 branches, according to Dan Harsono, the chief marketing officer.

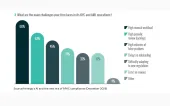

Financial transactions via e-banking are higher than using traditional branch channels, with growth in both internet and mobile banking.

However, the bulk of transactions are still made through ATMs, with BAY's total financial transactions numbering 6-7 million a month, he said.

"BAY will continue to improve e-banking services with the goal of increasing banking transactions," said Mr. Harsono.

For more.

Advertise

Advertise