Open Banking Set To Transform The Finance Sector

By Irene XuThere is a revolution going on today in the banking industry. Those bastions of privacy and money management are doing the unthinkable - with consent, they are sharing their customer data with approved third parties. In the past, banks jealously safeguarded their clients’ information. That is what clients expected of them, as well as it being a regulatory obligation. Today, they are making this information available to other players in the financial services arena, creating an unprecedented financial ecosystem built around making their Application Programming Interfaces (APIs) available to approved third parties.

Known as “Open Banking”, this is a global movement, supported by governments and regulators worldwide. This huge, transformative shift is radically changing the way banks approach business models for continued growth, customer’s choice and convenience, and financial inclusion under the digital economy.

Open banking enhances customer service

The collaboration brought by Open Banking allows banks and financial institutions to gain more insights by securely sharing customer account or transaction data with third-party stakeholders – with customers’ permission. This can be used to provide more personalised recommendations to customers based on real-time, data-based insights. For consumers, it provides more options in making payments with improved convenience and benefits – for instance, by enabling them to easily keep track of their balances and outgoings.

There’s added value for third parties too. For example, as merchants process the transactions there will be no interchange or scheme fees, or chargebacks. Not only does this make the processing seamless and quicker, but it also lowers the overall operational cost for the business. Some of these savings can be translated to better pricing for consumers too, so it’s Win-Win-Win for all in this new ecosystem.

The third-party service providers accessing the customer’s data with their permission could include insurance companies, utilities, retailers, e-commerce marketplaces or even travel firms and food delivery services. Consumers can easily check how much they spend on groceries, make a comparison of health insurance costs, and review their car loan or mortgage payments. They can personalise price comparison websites and easily make direct payments from their bank account.

Benefits for SMEs

Open banking enables businesses to improve and speed up their operations. Small and medium enterprises (SMEs), for example, traditionally face extreme difficulty in accessing finances. SMEs are often associated with higher risks, insufficient credit history, lack of collateral, and higher transaction costs — about 50% of small business loans get rejected. Not only that, the lending process is rather laborious and time consuming, thus it is a lower priority for the bank but a huge pain to the SMEs.

Now, the AI that powers open banking will bring significant changes that deliver distinctive customer experiences. Together with the use of APIs and automation, banks can aggregate all the information that exists on the applicant’s banking history, from all sources, and improve their credit assessment. The turnaround time will shorten from two to three weeks under the legacy process to as little as two to three days. An example is the “Mizuho Smart Business Loan” services for SMEs, the first of its kind in Japan market.

Advantages to banks

For banks, Open Banking means gaining access to incremental data about their customers and working in partnership with players in this new ecosystem. This will tremendously improve their ability to deliver accurate credit assessments, offer more risk-based pricing at a personalised level, design better products and services, reduce false positives in fraud detection and deliver frictionless customer experience. The key is analytics and AI.

Wherever there is data, there needs to be analytics. Data without analytics is value not yet realised. Through the use of analytics and AI and embracing open innovation, banks will shift from product-driven conversation to more customer need-based engagement, no matter where the customer is in the journey.

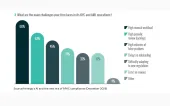

The trend is global, but it is being activated in different ways. In the EU, UK, Korea, Australia and India governments are looking to stimulate competition by mandating banks to open up their troves of account data to other companies. In the US and China, the movement is market-led, with companies setting up open banking relationships among themselves.

Singapore is following a blend of these two models, under the regulation of the Monetary Authority of Singapore (MAS). MAS is encouraging banks to open up and expand their data and services through APIX, an API guidance and collaboration platform. This is intended to pave the way for more openness in the financial services sector. Singapore banks are eagerly embracing the opportunities, actively using APIs to become an integral member of third party ecosystems or building their own marketplaces.

AI versus human intuition

Some concerns have been expressed that an algorithm lacks the empathy that a human being might feel for an SME customer who desperately needs a loan. With AI, it can be seen as an emotionless decision, with the human element removed. In fact, AI and machine learning can actually enhance the loan approval process, through more comprehensive understanding of the customer’s business and financial performance with data from all sources, giving the financial institution more confidence in advancing a loan than just relying on human intuition or business rules in the traditional process.

The benefits outweigh the risks

While there is increasing adoption of Open Banking in this region, there is still has a long way to go, and concerns around security, privacy and fraud remain. Some major concern revolves around how to ensure privacy and security once the data goes outside the safe confines of the bank’s environment; fraudsters can take advantage of APIs, which is a risk for consumers, banks and third-party providers.

Unfortunately, this type of crime will not go away by itself, and breaches due to poor security may happen from time to time. Banks need to work with all players in this ecosystem to make the infrastructure more accessible while attempting to alleviate the security threats and data-privacy concerns with new technologies. At the same time, individuals need to play a part and take the well-publicised steps to protect their own accounts and personal information.

The essence of Open Banking is transparency and fairness. As long as robust measures are put in place to protect the integrity and security of customer data, there is no doubt that Open Banking is not only here to stay, and will be a vital part of the digital economy.

Advertise

Advertise