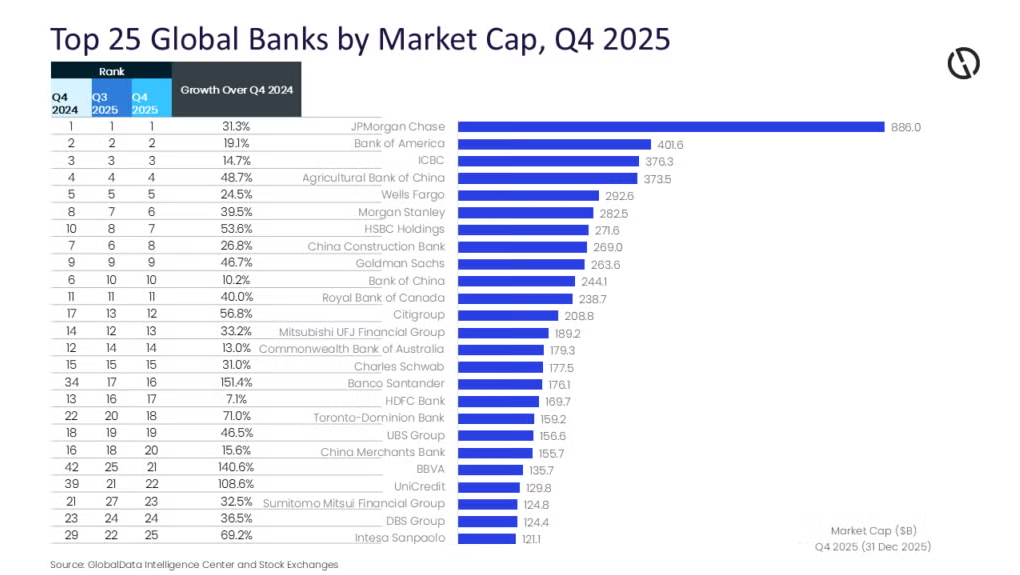

Top 25 banks reach $6.1t market value in Q4 2025

GlobalData said banks are entering 2026 with a more stable outlook.

The combined market value of the world’s 25 biggest banks rose 35.8% year on year to $6.1t by the end of the fourth quarter on 31 December 2025 (Q4 2025), according to data from GlobalData.

The increase was seen across North America, Europe and parts of Asia, supported by steady earnings, interest rates staying higher for longer and stronger investor demand for bank stocks.

Chinese banks stayed firmly in the top tier. Industrial and Commercial Bank of China ranked third globally, with its market value up 14.7% to $376.3b.

Agricultural Bank of China rose 48.7% to $373.5b, narrowing the gap with its larger peers.

China Construction Bank increased 26.8% to $269b, although it slipped to eighth place, while Bank of China rose 10.2% to $244.1b and held tenth.

GlobalData said investor confidence was supported by policy measures and signs of improving asset quality, despite an uneven economic recovery.

Elsewhere in Asia-Pacific, Japan’s Mitsubishi UFJ Financial Group saw its market value rise 33.2% to $189.2b, while Sumitomo Mitsui Financial Group gained 32.5% to $124.8b.

Singapore’s DBS Group increased 36.5% to $124.4b. In India, HDFC Bank grew 7.1% to $169.7b, remaining one of the largest banks in emerging markets.

GlobalData said banks are entering 2026 with a more stable outlook, backed by strong capital positions and better risk controls.

However, it warned that slower growth, expected interest rate cuts and ongoing pressures in areas such as commercial real estate could weigh on margins, particularly for some US regional lenders.

Advertise

Advertise