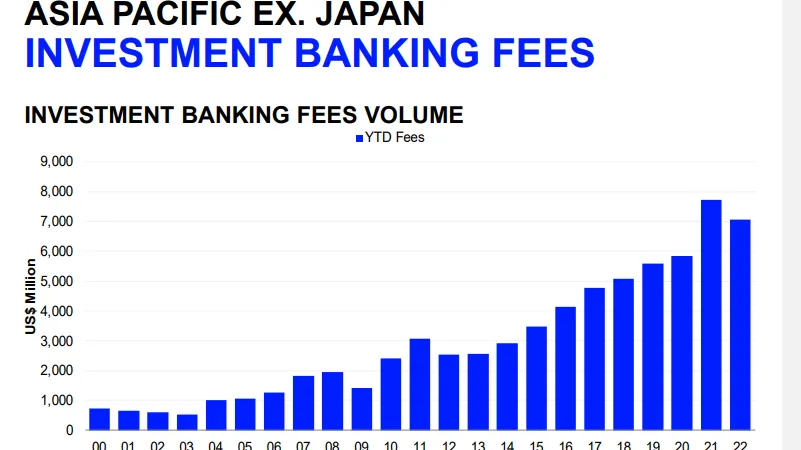

APAC investment banking fees drops 8.5% in Q1 2022

This comes after its all time high in the same quarter last year.

Investment banking fees in Asia Pacific excluding Japan reached an estimated $7.1b in the first quarter of 2022, an 8.5% drop from last year’s numbers according to the investment banking report for Q1 2022 by Refinitv.

Equity capital markets (ECM) fees totaled $1.9b in Q1 2022, a 32.2% decline compared to last year’s figures. Debt capital markets (DCM) underwriting fees totaled $3.6b, up 20.6% from a year ago, surpassing the record start set during the first quarter of 2020. Fees generated from completed M&A transactions totaled $854.9m, a 1.1% increase from a year ago. Syndicated loan fees fell 32.7% YoY and reached $758m.

DCM fees accounted for 50.4% of the overall Asia Pacific investment banking fee pool, followed by ECM underwriting fees with 26.8%. Completed M&A advisory fees represented 12.1% of the region’s investment banking fees, followed by Syndicated lending fees with 10.7%. CITIC took the top position for overall investment banking fees in Asia Pacific, excluding Japan, with 6.6% of the wallet share.

You May Also Like:

India’s HDFC Bank merging with housing company HDFC

CIMB Niaga, Sun Life Indonesia deepen bancassurance partnership

Advertise

Advertise