ZA Bank kicks off sandbox trial for online business account opening service

Trial for ZA Dash will run until 30 December.

Hong Kong-based virtual lender ZA Bank has kicked off the sandbox trial of ZA Dash, an express online business account opening service, and is inviting up to 100 local small and medium enterprises (SMEs) to participate in the launch.

The sandbox trial of ZA Dash will run for a month until 30 December 2022.

"The launch of the sandbox trial of ZA Dash demonstrates our strong commitment to leveraging our digital edge to ease the burden on SMEs, bringing us one step closer to achieving our vision. We hope ZA Dash can become the starting point of SMEs’ journey in digital finance, making financing easier for them," said Devon Sin, Alternate Chief Executive of ZA Bank.

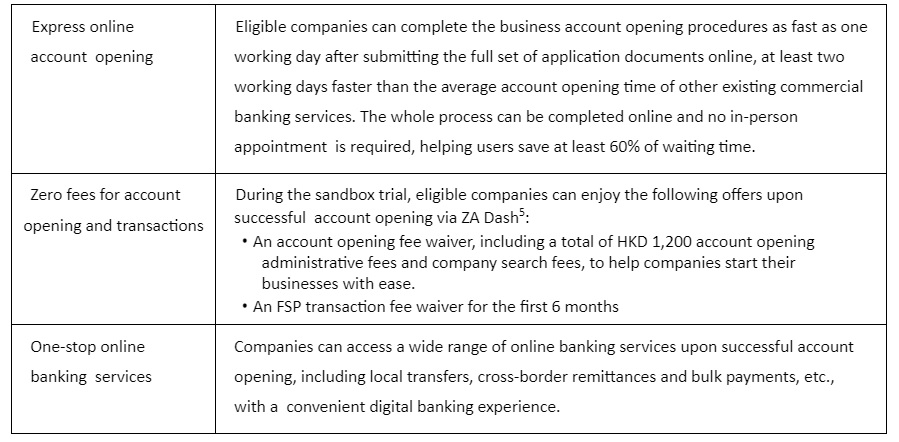

ZA Dash offers the following features:

SMEs must be registered and operating in Hong Kong, and with tax jurisdiction in Hong Kong only, in order to participate.

They are also required to meet other account opening requirements specified by ZA Bank.

Interested SMEs may apply at the ZA Bank website and will be accepted at a first-come, first-served basis.

Advertise

Advertise