Taiwan’s domestic banks extended $1.23t in loans as of end-March

The average bad loans ratio is 0.16%.

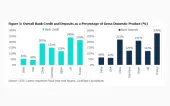

Taiwan’s 38 domestic banks have extended $1.23t (NT$39.59t) in loans by the end of March 2024, according to data from the Financial Supervisory Commission (FSC). This is about $14.49b (NT$463.4b) higher than in February.

The total non-performing loans (NPLs) of these banks came at $2.03b (NT$65.05b) as of March, a $59.27m (NT$1.89b) increase from a month ago.

ALSO READ: Why tech is not the focal point of banks’ digital transformations

Average NPL ratio of the 38 banks remains at 0.16%, the same as in February, and 0.01 percentage point higher than in March 2023.

Coverage ratios of allowances for NPLs declined by 22.38 percentage points to 825.58% in March.

(US$1 = NT$31.99)

Advertise

Advertise