CITIC leads China investment banking fees as market hits 3-year high

It retained its position as the top financial institution in terms of IB fees raised.

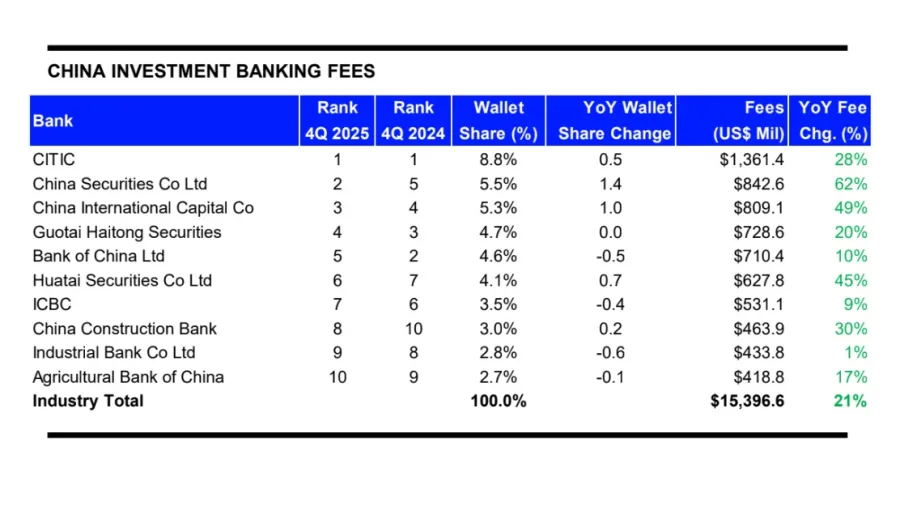

CITIC emerged as the financial institution who raised the most investment banking (IB) fees in China during the last three months of 2025, according to data from LSEG.

CITIC recorded $1.35b in IB fees during the quarter alone, representing 8.8% of the total wallet share. Its fees is 28% year-on-year (YoY) higher than in Q4 2024.

China Securities Co. Ltd. ranked second, with $842.6m in fees or 5.5% of the total wallet share. China International Capital Co. ($809.1m, 5.3% of the market share) and Guotai Haitong Securities ($728.6m, 4.7% of the wallet share) followed.

Bank of China Ltd. rounded up the top five, raising $710.4m in IB fees during the quarter. This is equal to 4.6% of the wallet share, and is 10% higher than the IB fees it recorded in Q4 2024.

IB fees in China reached $15.4b in 2025, its highest since 2022, LSEG said in a report published in January 2026.

The remaining members of China’s “big four” megabanks made it into the top 10. ICBC ranked seventh, raising $531.1m; China Construction Bank came in eighth place, raising $463.9m in fees; and Agricultural Bank of China ranked tenth, with $418.8m in IB fees.

Industrial Bank Co Ltd was ninth, with $433.8m in IB fees garnered in Q4 2025.

Top player CITIC Bank is expected to maintain stable asset quality, capitalisation profitability, and liquidity through mid-2027.

Risks include the formation of new non-performing loans (NPLs) because of “unseasoned risks in financing domestic economic transition and rising asset risks from the retail loan book.”

Industrial Bank also holds a stable outlook with the narrowing of its net interest margin (NIM) expected to slow during the period thanks to lower deposit rates.

Advertise

Advertise