Indonesia

Indonesia’s Islamic loans to grow 10% but banks capped at 8% market share

Indonesia’s Islamic loans to grow 10% but banks capped at 8% market share

Bank Syariah Indonesia (Persero) is likely to remain dominant.

BNI braces for NIM compression in 2026 on tighter H1 liquidity

NIM is estimated to fall between 3.5% to 3.8%, lower than Q4 2025’s 3.9%.

Indonesia loan demand stagnates as MSME and consumption slumps

Underlying demand for loans remains uneven although liquidity will be abundant, analyst said.

Payroll drives rural Indonesia banking uptake as digital banks fail to sway users

Digital banks are known but users said there is no difference in app experience.

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

HSB collects ground-level fraud signals that are captured in standardised entries.

Indonesia's Artajasa ties up with Ant International on cross-border payments

Artajasa connects over 80,000 ATMs and 41 million merchants in Indonesia.

BNI speeds approvals as centralised trade platform takes hold

Processing is now completed in less than 24 hours.

Indonesia loan growth cooled in 2025 as 12% target looks tough: UOBKH

The central bank successfully addressed funding constraints, but borrowers remain cautious.

Indonesia’s Jalin targets payment fraud with BPC tie up

Jalin will expand its utilisation of BPC tech for real-time fraud monitoring.

Indonesian banks’ credit costs may stay high in 2026 on weather risk

Major banks should still be able to deliver positive earnings growth of 1%-7%.

Which Indonesian banks are most exposed to Sumatra flooding?

BRI has the largest absolute exposure whilst BRIS has high exposure, UOBKH said.

Indonesia’s big four banks to hit 9.3% loan growth in 2026

Wholesale loans and microloans will growth during the year.

Indonesia's Superbank raises $167.06m in IPO

It will use 70% of the proceeds for working capital and 30% for capital expenditure.

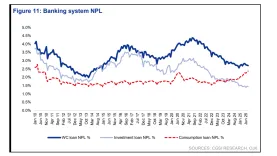

Indonesia banks see NPLs climb on mortgage and vehicle loan strain

CGSI said that banks should be more cautious of auto loans than mortgages.

Wholesale lending to lift Indonesian banks’ loan growth

Average loan growth is expected to rise to 9% in 2026.

Airwallex secures majority ownership of PT Skye Sab Indonesia

Indonesian merchants wanting to expand overseas can now do so via Airwallex.

Indonesian banks’ weak loans improve with ample coverage for risks

Pockets of vulnerabilities remain in certain sectors, like the textile industry.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership