Banks must amp up management of nature risks in net zero policies: WWF

Science-based decarbonisation targets must be set to improve their energy sector portfolios.

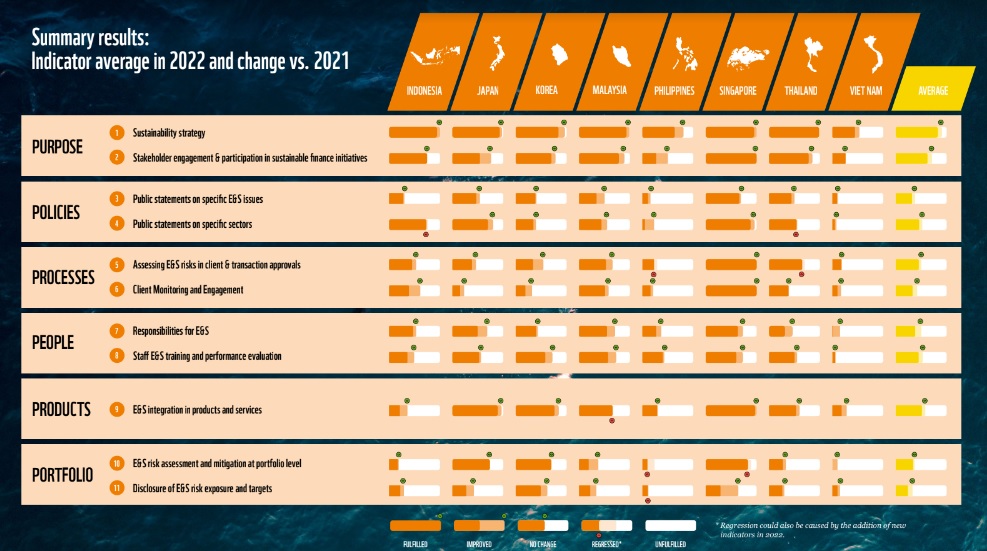

Whilst the number of Asian banks that committed to net zero financed emissions doubled in 2022, more needs to be done to manage nature-related risks in their policies, according to the latest sustainable banking assessment report released by the World Wide Fund for Nature (WWF).

Net zero commitments amongst assessed banks rose to 18 banks or 39% of all banks studied by WWF across Asia in 2022, from only seven banks or 15% in 2021.

Despite the jump in numbers, WWF noted that over half of those who committed to net zero virtually remained stagnant in 2022, making little or no progress since a year prior.

Only half of the banks assessed made significant progress in integrating environmental and social (E&S) considerations into their decision-making, the report said.

ALSO READ: Thailand’s KBank earmarks $5.53b for sustainable funding, loans

The majority of banks assessed in Singapore, Japan, and Korea have committed to net zero, the report found. A number of banks in Malaysia and Thailand have also made net-zero commitments. Also listed are a few banks in Indonesia, the Philippines, and Vietnam.

Singaporean, Indonesian, and Malaysian banks, on average, meet at least 70% of the criteria for recognising nature-related risks, WWF said. However, this recognition of risk is not reflected within client expectations and policies on nature-related issues.

“Only 40% of the criteria is met by Singaporean banks for setting client expectations on nature-related risk while other assessed countries meet only 20% of the criteria or lower,” said Kristina Anguelova, WWF Singapore’s head of sustainable finance.

Developing capacity to identify, assess and manage nature-related risks will be crucial for banks given the targets set by the recent Kunming-Montreal Global Biodiversity Framework (GBF) and the Taskforce on Nature-related Financial Disclosures (TNFD) framework, she added.

“Equally momentous, for all banks, is to develop science-based targets that guide the decarbonisation of their portfolios aligned with 1.5-degree pathways, along with credible transition plans, that go beyond climate and start to incorporate nature ambition,” Anguelova said.

Science-based decarbonisation targets still present a main gap for energy sector portfolios, with only 11% of banks setting targets in this area.

“An analysis of the energy sector, the source of three-quarters of global greenhouse gas emissions, emphasised a greater need for more banks to set science-based targets to transition their energy portfolio, regardless of current incentives from regulators,” the WWF report read.

In this are, having regulators require banks to set science-based targets and develop transition plans may encourage take-up. WWF found that most regulators from the countries assessed have not yet required these.

Advertise

Advertise