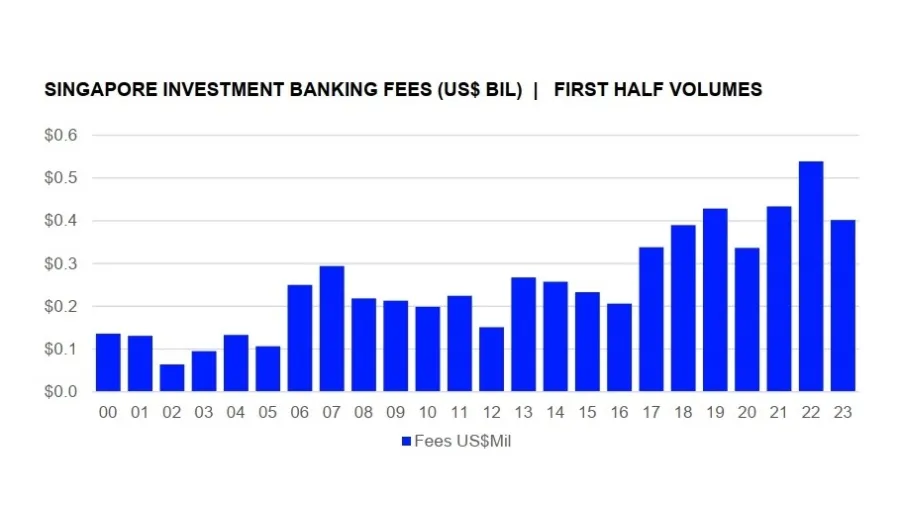

Singapore’s investment banking fees 25% lower in H1 2023

BofA Securities currently leads investment banks in terms of fees generated.

Singapore generated an estimated US$401.8m worth of investment banking fees in the first six months of 2023, 25% lower than in the same period in 2022, according to data gathered by Refinitiv.

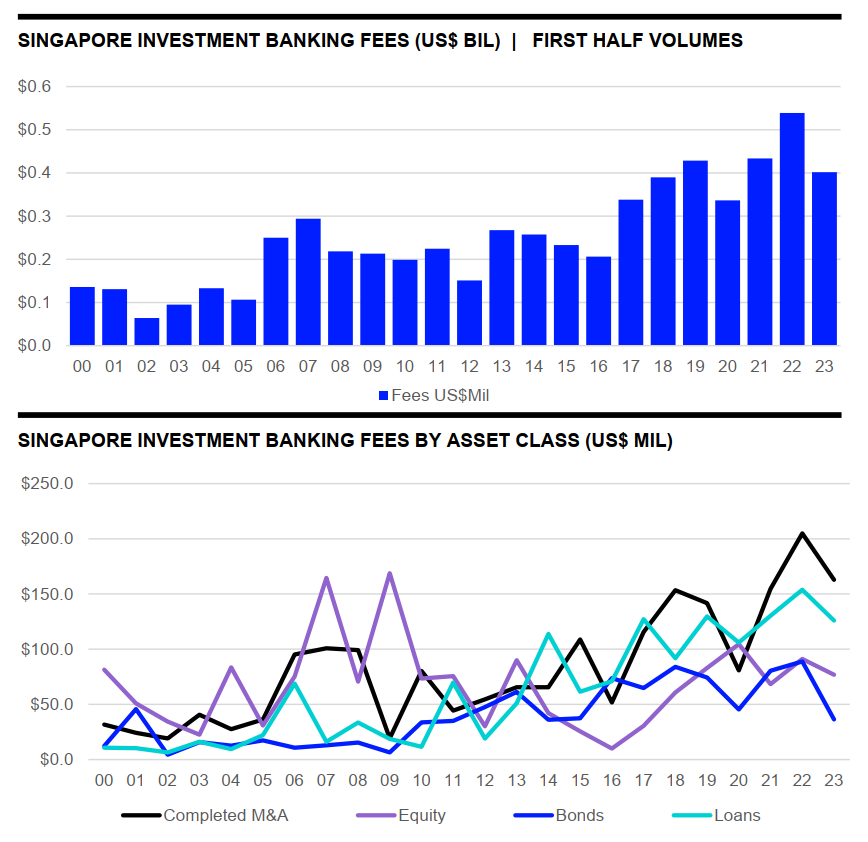

Equity capital market underwriting fees fell by 16% during the period, reaching US$76.8m. Debt capital market fees dropped 59% from a year ago to US$36.4m.

Syndicated lending fees also registered an 18% decline to US$125.9m, and advisory fees also fell to US$162.8m, 21% lower than a year ago.

Amongst banks in Singapore, BofA Securities currently leads Singapore’s investment banks in terms of fees generated in 2023, with a total of US$54.2m. This is 13.5% of the wallet share of the total fee pool, according to Refinitiv.

Advertise

Advertise