Singapore Investment Banking Fee

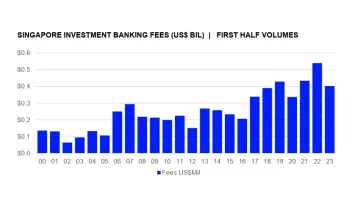

Singapore’s investment banking fees 25% lower in H1 2023

Singapore’s investment banking fees 25% lower in H1 2023

BofA Securities currently leads investment banks in terms of fees generated.

Singapore’s investment banking fees rise 3.3% in first half of 2022

However, DCM underwriting fees were slightly lower than in 2021.

SG's investment banking fees rise 30.2%

Investment banking activities generated $725.5m in fees.

Join the community

Thought Leadership Centre

Most Read

1. OCBC new investors triple as bank braces for 2026 gold, silver uptick 2. How digital payments are forcing QSRs to rebuild checkout and staffing 3. DBS pilots Visa Intelligent Commerce for agent-initiated payments 4. Japanese banks face bond yield shocks as yields hit 2.23% 5. BEA’s profit down 24% to $447.87m in 2025 as China losses mountResource Center

Events

Event News

Pricing Discipline, Customer Value: Asian Banking & Finance and Insurance Asia Summit Heads to Bangkok

Speakers from Kasikornbank, KPMG Thailand, Systemweb Technology, and Simon-Kucher will share their insights on the industry’s latest trends and challenges.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership