APAC M&A down 18.8% 11M’23

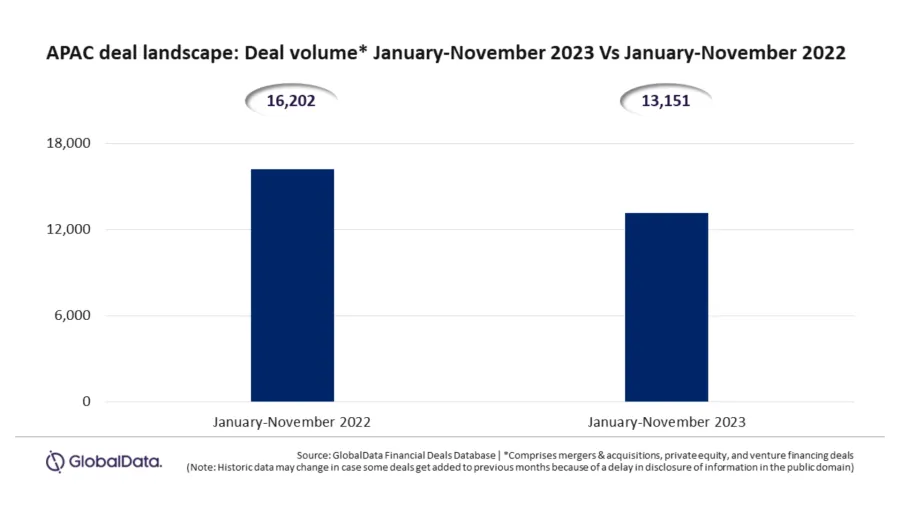

The region saw a total of 13,151 deals in the eleven months to November.

From January to November, a total of 13,151 deals (encompassing mergers & acquisitions (M&A), private equity, and venture financing) were announced in the Asia-Pacific (APAC) region.

This figure reflects an 18.8% year-on-year decline compared to the 16,202 deals reported during the same period in the previous year, according to data and analytics company GlobalData.

An analysis of GlobalData’s Financial Deals Database indicates that all deal types covered in the report experienced a decrease in volume from January to November. Specifically,

M&A deals saw a 10.9% decline, while the volume of private equity and venture financing deals fell by 21% and 25.6%, respectively.

ALSO READ: Singapore’s investment banking fees decline on fewer M&As

“In line with the worldwide trend, the APAC region also witnessed a dip in deal-making sentiments. However, the impact was relatively less pronounced compared to other regions.” Aurojyoti Bose, Lead Analyst at GlobalData said.

Comparatively, other regions such as North America, Europe, the Middle East and Africa, and South and Central America experienced greater declines in deal volume at 28.6%, 19.4%, 25.7%, and 30.6%, respectively, compared to the APAC region.

Within the APAC region, key markets, including China, India, Japan, Australia, South Korea, Singapore, Hong Kong, Indonesia, and New Zealand, recorded year-on-year declines in deal volume by 13.4%, 26.3%, 15%, 20.6%, 28.1%, 20.4%, 23.3%, 35.9%, and 12.8%, respectively.

Advertise

Advertise