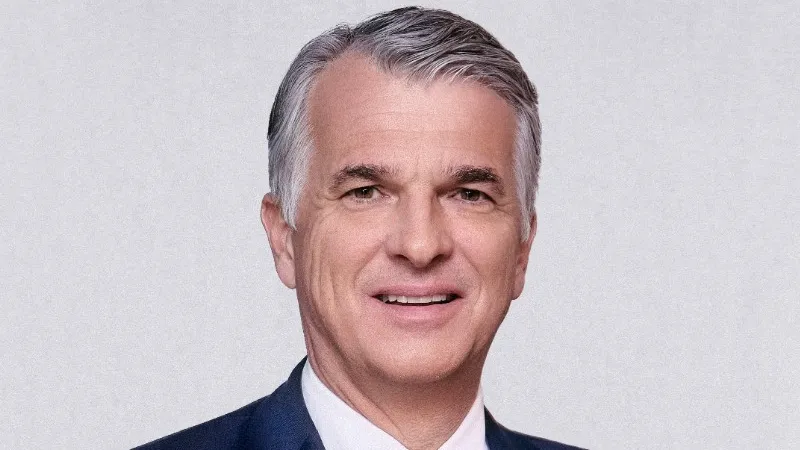

Sergio Ermotti returns as UBS CEO

The UBS board says his experience is ideal to manage the Credit Suisse acquisition.

Sergio P. Ermotti has been appointed as UBS Chief Executive Officer (CEO) as part of the bank’s new priorities following the Credit Suisse acquisition.

The Swiss bank said that Ermotti’s role as Group CEO and president of the Group Executive Board will begin on 5 April 2023 after the Annual General Meeting.

“I am conscious of the uncertainty many feel and I promise that, together with my colleagues, our full attention will be on delivering the best possible outcome for our clients, our employees, our shareholders and the Swiss government,” Ermotti said

ALSO READ: Interest rates will be Singapore banks’ boon and bane through 2023: analyst

Ermotti will succeed Ralph Hamers, who stepped down as CEO and will resume working with Ermotti as an advisor during the smooth transition process.

“Integrating Credit Suisse is UBS’s single most important task and I am confident that Sergio will successfully guide the bank through this next phase,” Hamers said.

Hamers expressed that his stepping down in the interests of the new combined entity and its stakeholders, including Switzerland and the financial sector.

Advertise

Advertise