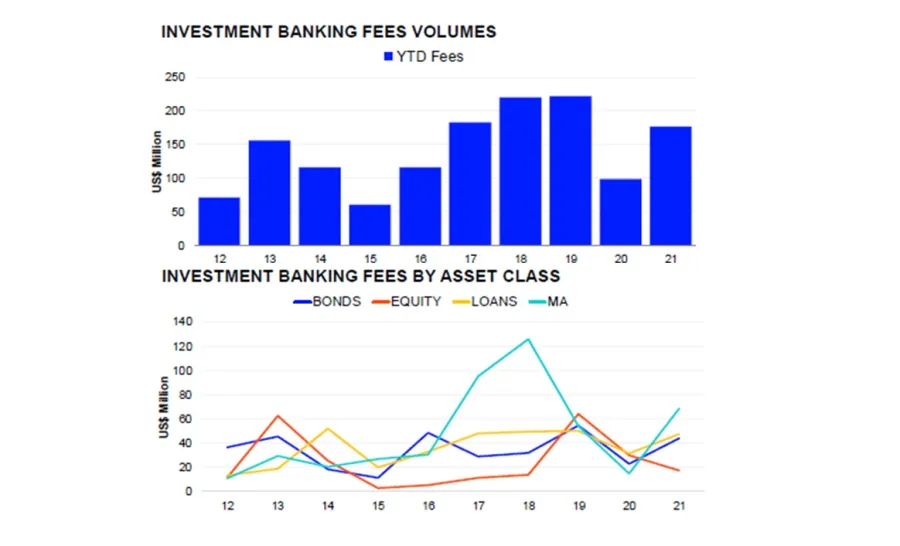

Singapore investment banking fees up 79% to $176.5m in Q1

M&As are off to a slow start whilst there was only one IPO by a local company so far.

Singapore investment banking activities totalled US$176.5m in fees so far in 2021, already 79% higher than in Q1 2020, according to data compiled by Refinitiv.

Equity and equity-linked (ECM) issuance by Singaporean companies raised US$875.8m so far in 2021, a 7.3% increase from Q1 2020. Follow-on offerings grew 89% from the comparative period last year, with US$362.4m worth of proceeds, Refinitiv found.

Despite this, ECM underwriting fees fell 42.6% to US$17.1m over the same period.

There is only one initial public offering (IPO) by a Singaporean company so far this year – Aztec Global’s US$221.1m SGX IPO. In contrast, there were at least 8 IPOs by Singaporean issuers during the first quarter of 2020, collectively raising US$624.4m.

By sector, real estate accounted for 37.1% of Singapore’s ECM proceeds, followed by financials and technology with 33.4% and 25.2% market share, respectively. Amongst institutions, DBS Group currently leads Singapore’s ECM underwriting rankings, with a 20.8% market share and US$182.1m in related proceeds.

In the debt capital markets, primary bond offerings from Singapore-domiciled issuers witnessed a record start raising US$10b so far this year, more than double or 122.3% higher than in Q1 2020.

Singaporean companies from the financials sector captured 62.9% market share and raised US$6.3 billion during the first quarter of this year, almost triple or a 188.4% jump from the same period last year. Government & Agencies followed behind with 12.8% market share worth US$1.3b, a 153.5% rise from a year ago.

Real Estate rounded out the top three with an 11% market share. Once more, DBS Group leads the Singapore bonds underwriting with US$1.3b in related proceeds, or 12.9% market share.

Slow start for M&As

Announced mergers & acquisitions (M&A) started slow in 2021 with deals just amounting to US$16.5b, 31.6% lower compared to the first quarter of 2020. Four deals announced are said to be worth above US$1b, with an aggregate total of US$8.3b.

Of these billion-dollar M&A deals announced, not one is greater than US$5b, noted Refinitiv. In contrast, in Q1 2020, of the four billion-dollar deals announced, one deal surpassed US$5b in quantum.

Singapore-targeted M&A activity amounted to US$2.2b, down 80.7% compared to the same period in 2020. Domestic M&A is down 94.6% over the same period of comparison and totaled US$499.2m so far this year.

Inbound M&A activity reached US$1.7b, down 20.8% from Q1 2020; whilst outbound M&A activity by Singaporean companies reached US$9.5 billion in deal value, only 7.5% lower in value from Q1 2020. United States was the most targeted nation capturing 57.8% market share, Refinitiv data found.

Majority of the activity involving Singapore happened in the industrials and high technology sectors, Refinitiv found.

The Industrials sector captured 32.3% of market share and totaled US$5.3b, up 72.8% from a year ago. This is followed by High Technology, which saw the highest volume of deals, with a 22.8% market share by value. Energy & Power closed the top three with a 12.6% market share in value.

Amongst institutions, Goldman Sachs currently leads Singapore’s M&A league table rankings so far in 2021, with 37.6% market share and US$6.2b in related deal value.

Advertise

Advertise