Why Islamic Banks will be the biggest winners post-COVID

A young, tech-savvy population and a growing preference for ESG banking are amongst the reasons why Islamic Banks will take flight.

Southeast Asia’s Islamic banking sector is poised to enjoy long-term growth prospects thanks to a young, growing population demanding Shariah-based products and government support, analysts said.

Shariah-compliant banks are expected to overtake the growth and expansion of their conventional peers in the region, according to S&P Global Ratings, particularly in the post-COVID world when demand for Shariah-compliant financial services is expected to rise.

“In our view, Islamic banks benefit from government support, a large Muslim population in many countries in Southeast Asia (SEA), and strong demand for Sharia-compliant financial products. Additional benefits include increased standardization of contracts, and potential unification of the global legal and regulatory framework for Islamic finance,” according to an S&P report by Geeta Chugh, Rujun Duan, Nikita Anand, Amit Pandey, and Ivan Tan.

Bank Islam Malaysia Berhad CEO En Mohd Muazzam Mohamed shares the same view, although he notes that the pace of economic recovery remains uncertain.

“On the domestic front, the recovery signs show that downside risks remain over the uncertainty path of COVID-19 and the efficacy of the vaccine. We expect the economic recovery to pick up from the second quarter of 2021 onwards, following improvement in external demand, higher public and private sector activities, and the latest economic indicators signal recovery is underway,” Mohd Muazzam told Asian Banking & Finance in an exclusive interview.

Shariah-compliant banks from these markets, particularly in Malaysia, have already showcased asset quality resilience and strong capitalization even during the pandemic. This will enable them to meet increased demand for financing as economies recover from the pandemic, said Moody’s Investors Service.

Mohd Muazzam also noted that Islamic banks have historically fared stronger compared to their conventional peers during dire times, most notably during the 2008 Global Financial Crisis.

Not without challenges

Bank Islam's chief noted that Islamic banks have also been affected since the onset of the pandemic in 2020 and businesses are expected to remain muted in the near term.

“Although global Islamic banking assets record higher market share at 91.4% in 2019, due to increased exposure to the real economy, the industry is expected to record declined revenue, high pressure on earnings, and lower year-on-year growth in 2020 as the focus will be on preserving asset quality at the expense of business growth,” he said.

Amidst new waves of infection, Islamic bank growth rates are expected to moderate with asset quality stress persisting for longer, S&P also noted. The ratings agency forecasts that between 2020 to end-2021, the industry will show low- to mid-single-digit growth.

“Whether it is conventional or Islamic banking, challenges remain real to both universes,” Mohd Muazzam said.

But instead of focusing on the possibility of muted growth, Mohd Muazzam shared that Bank Islam is looking ahead: that is, on how COVID could be a catalyst for change for Malaysia’s Islamic banking industry.

“[We] see COVID-19 as an opportunity to move forward sustainably. Such a far-reaching impact of one single virus raises a simple question: is there a systematic error in how we operate, and what can be done to correct it?”

Catalyst

It wasn’t just the pandemic that is driving such changes, however. The current era is rife with key drivers that will propel the Islamic banking industry to grow and improve, in Mohd Muazzam's view.

Amongst these drivers is the advent of fintech, both as a competitor and as possible partners, which Mohd Muazzam said will help enhance the industry's resilience. Lockdown measures have demonstrated how the capacity of a company or a bank to shift its business online is critical for its continuity, according to Bank Islam’s CEO.

“The current environment provides opportunities for accelerating and unlocking the long term potential of the industry: more integrated and higher standardisation such as standardising Sukuk issuance ruling; stronger focus on the industry's social role, such as in regards to [environment, social, and governance (ESG)],” he said.

“Industry players have been discussing the potential use of social instruments to help companies and individuals economically affected by the pandemic. We can also see greater use of fintech, where lockdown measures have also shown the importance of leveraging technology and creating a nimbler industry,” he added.

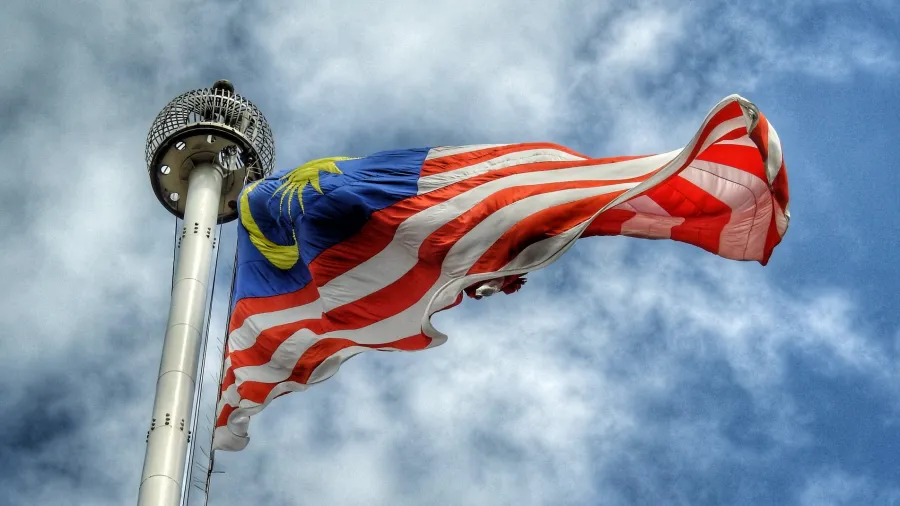

In Malaysia, government support is also a key catalyst for growth. The country is already noted as the leader in Islamic finance in South and Southeast Asia, and the officials are reportedly taking steps that will further strengthen its position, according to Moody’s.

Just this year, as part of a push for Islamic banks to adopt value-based intermediation—an impact-based approach underpinned by Shariah principles—the Central Bank decided to expand guidelines for Islamic banks to incorporate ESG considerations in financing. This is aimed at helping them avoid prematurely writing down or devaluing assets because of uncertainty surrounding governments' environmental policies and identifying new growth opportunities, such as those related to the renewable energy sector.

To encourage more uptake of Shariah-compliant financial services, Bank Islam’s CEO also suggested that incentives can be engineered to encourage the concept of "circular economy" through waqf—an Islamic financial tool/concept that thrives on the act of philanthropy.

No-touch model

If anything, the pandemic acted more as an accelerator on already-present trends that have long been changing the banking space, one of which is technological innovation, Myles Bertrand, managing director APAC of cloud banking platform Mambu, told Asian Banking & Finance.

“We’re seeing a lot of Islamic banks, as well as conventional banks that offer Shariah-compliant financial products, consciously moving towards digital offerings. They want to be able to offer their customers access to Shariah-compliant services from their smartphones or online, which is where customers now expect to manage their finances,” Bertrand said.

Nowadays, customers expect to be able to engage banks through a "low touch" model, or without the need to visit a physical branch, Bertrand said, and this also holds true for Islamic lenders.

Customers also expect a personalised experience, so being able to offer unique, individualised products, and services that deliver a superior customer experience is key.

“We believe that technological innovation in the Islamic banking industry is going to drive huge growth in the sector as more and more people find that they are able to access Shariah-compliant services. Islamic banks that fail to innovate digitally are going to be left behind,” Bertrand said.

He added that this trend holds important implications for those segments of the population that are still technically "unbanked" or "underbanked."

Demographic wins

Perhaps the biggest driver of growth for Islamic banks in the future is that the population is on their side. SEA countries feature young, growing populations with cultural affinity to halal products and services, which will fundamentally underpin demand for Islamic financial services, according to Moody’s.

“Prime-age populations, or people aged 25-54 years, are growing fast in Muslim-majority countries in South and Southeast Asia,” Moody’s analysts, Tengfu Li, Nitish Bhojnagarwala, Chong Jun (CJ) Wong said in a report. “Apart from cultural affinity, corresponding increases in smartphone ownership will also aid the expansion of Islamic banking, especially with the progressive rollout of electronic know-your-customer services that will facilitate remote verification of identification.”

Mambu’s Bertrand also highlighted the impact of Gen Z and Millennials in the future of Shariah-compliant banking. “Millennial and Gen-Z consumers are driving demand for more ethical services, which will, in turn, have a positive impact on the uptake of Islamic banking services; So it won’t just be people who identify as Muslims who utilise Shariah-compliant banking services, it will be anyone who is looking for more ethical investment or banking opportunities,” he said.

Moody’s analysts note that there is a largely untapped market for Islamic banks in the region, particularly in Malaysia, Indonesia, Bangladesh, and Brunei, with many adults still not using financial services.

The expansion of prime-age populations means that the retail segment will drive the growth of Islamic financing. To illustrate, financing growth in Malaysia and Indonesia in the first nine months of 2020 was mostly driven by demand for housing financing, noted Moody’s.

Advertise

Advertise