APAC developing markets slated to see lower margins in 2026

Except for Japanese banks, which could see NIMs rise faster if monetary tightening is more aggressive than expected.

Banks from the developing markets in Asia Pacific (APAC) could face greater pressure in their net interest margins (NIM) and earnings due to deeper interest-rate easing cycles, warned Fitch Ratings.

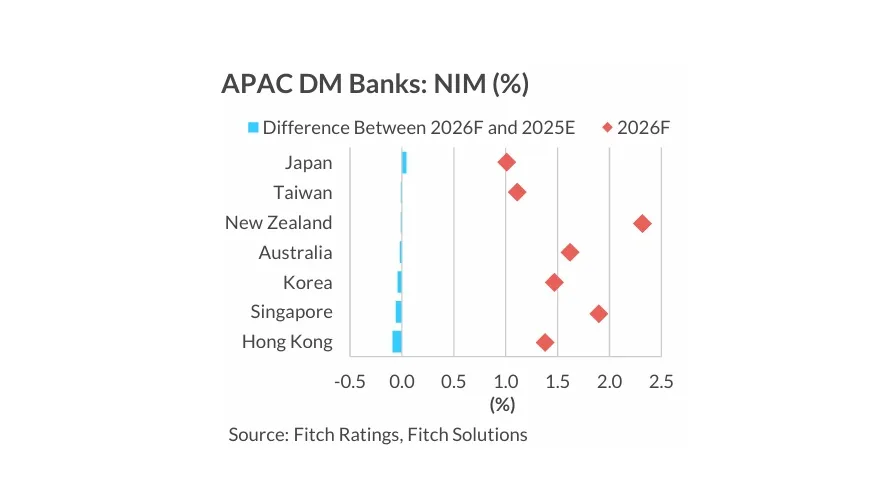

With the exception of Japan, the six markets— Taiwan, New Zealand, Australia, South Korea, Singapore, and Hong Kong— are expected to see margins fall in 2026, according to estimates by the ratings agency.

In contrast, Japanese banks’ NIMs could rise faster than anticipated if monetary tightening is more aggressive than forecasted.

“However, earnings are unlikely to benefit to the same extent, as credit costs are likely to increase as borrowers deal with higher interest rates and falling loan demand, and banks incur losses on domestic bond portfolios,” said Fitch Ratings’ experts Jonathan Cornish, Tim Roche, Tania Gold, and Grace Wu in the 2026 outlook report.

Earlier in 2025, Fitch had warned that banks in developed markets are expected to see greater pressure unless interest rates are higher than expected.

Advertise

Advertise