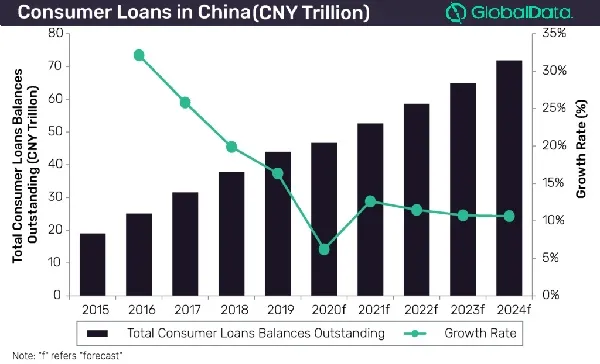

Chart of the Week: China's consumer lending market growth to stall at 6.2% in 2020

This is ten percentage points lower than the 16.3% growth recorded last year.

Growth of the Chinese consumer lending market is expected to slow to 6.2% to reach $6.7t in 2020, from the 16.3% growth recorded last year, data from analytics company GlobalData revealed.

As a result of the recent COVID-19 outbreak—which forced the country to lockdown cities and caused 50 million to undergo mandatory quarantine—the consumer loans market is expected to grow at a compound annual growth rate of 11.4% over 2020-2024. This is much slower than the CAGR of 23.4% reported from 2015 to 2019, with the market reaching $6.3t in 2019.

“Whilst the recent government measures like lowering of interest rates will make borrowing easier, it may not be sufficient in encouraging retail consumers to take any long-term loans, particularly large value mortgages,” noted Siddharth Agarwal, practice head of financial services at GlobalData.

Overall, the Chinese consumer loans market is forecasted to reach $10.3t in 2024.

China’s banking sector is also expected to take a hit from the rise in bad loans as retail customers are most vulnerable. Consumer default rate at some banks in China has reached 4%, accelerating from only around 1% before the outbreak.

“New retail loan applications would also see a drop as consumers become more cautious due to the growing economic uncertainty. Consumer spending will be impacted as more people will look to cut down on large value purchases and instead look to save money,” Agarwal said.

“Mortgage loans account for the largest share of consumer loans in China with almost 70% share in 2019. This segment is expected to see [the] highest drop in growth rates as new home buyers will delay their purchase decision as they expect property prices to fall in light of the expected global economic slowdown,” he added.

Meanwhile, the unemployment rate in China jumped from 5.2% in December 2019 to 6.2% in February 2020. As a result of this, banks are expected to become more cautious and to tighten lending criteria.

Advertise

Advertise