Chart of the Week: Japanese banks' real estate loans hit record high as risk appetite grows

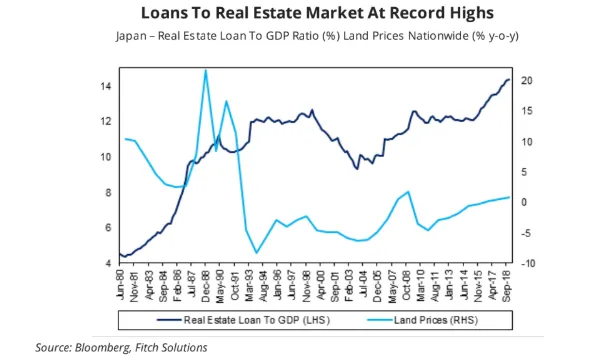

Loans to the real estate sector as a share of GDP hit 14.4% in late 2018.

Japanese banks have been stepping up lending to the real estate sector as loans to the segment as a share of GDP hit new record high of 14.4% in late 2018, according to Fitch Solutions, in a development indicating a possible increase in risk appetite from banks struggling to turn a profit.

Also read: Japanese banks risk-taking hits near 30 year high amidst profit crunch

Banks have increased their lending to real estate investment funds and to individuals that have been eyeing to buy rental housing, which the Bank of Japan (BoJ) believes to be undercapitalised. The firm added that this signifies Japan’s real estate market is not overheating contrary to the late 1980s given that land prices have been rising only at a moderate pace.

“Nevertheless, rising loans to the real estate sector exposes banks to potential downside risks to the domestic housing market,” Fitch Ratings said.

Also read: APAC banks grapple with growing property risks: Fitch

Banks in Japan have been turning to riskier lending practices in order to offset declining profits, at the expense of their capital ratios. In particular, the loans made by regional banks to companies with higher credit risk profiles, such as small firms, have increased.

Advertise

Advertise